This annual report will be presented to Parliament to meet the statutory reporting requirements of (insert relevant acts and regulations) and the requirements of Premier and Cabinet Circular PC013 Annual Reporting.

This report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Submitted on behalf of the Department of Treasury and Finance by:

David Reynolds

Chief Executive

Under Treasurer

From the Chief Executive

In 2020-21 the department continued to deliver its core services as well as providing data, advice and support to the government on issues associated with the COVID-19 pandemic including the re-allocation of staff to business grants and Homebuilder programs.

The health and wellbeing of our staff has been a focus this year, with the launch of the Wellbeing for our people program, incorporating mind, body, place and purpose. Recognising that wellbeing is highly individual, this program involves many initiatives, allowing employees to choose what suits them.

Many outcomes achieved this year are set out in this report, but the significant achievement is the flexibility and professionalism shown by the department’s staff in delivering these outcomes. Our staff continue to make an impressive effort, continually delivering, and making a difference so South Australia thrives.

David Reynolds

Chief Executive

Department of Treasury and Finance

Overview: about the agency

Our Purpose | Working together to support the future prosperity and wellbeing of all South Australians.* |

|---|---|

Our Values |

|

Our functions, objectives and deliverables | To ensure that the South Australian public sector is accountable in both policy and financial terms to the government of the day through providing economic and financial services to, and on behalf of, the Government of South Australia. Treasury and Finance provides key services to other government agencies and the community, including improving safety in South Australian workplaces, industrial relations services and corporate, business and procurement services. Our objectives are:

|

* It is noted that from 2021-22 the department’s purpose statement has been amended to: Making a difference so South Australia thrives.

During 2020-21 there were the following changes to the agency’s structure and objectives as a result of internal reviews or machinery of government changes.

- Transferred into Department of Treasury and Finance from 1 October 2020 from Department for Infrastructure and Transport.

- Parliamentary Network Support Group

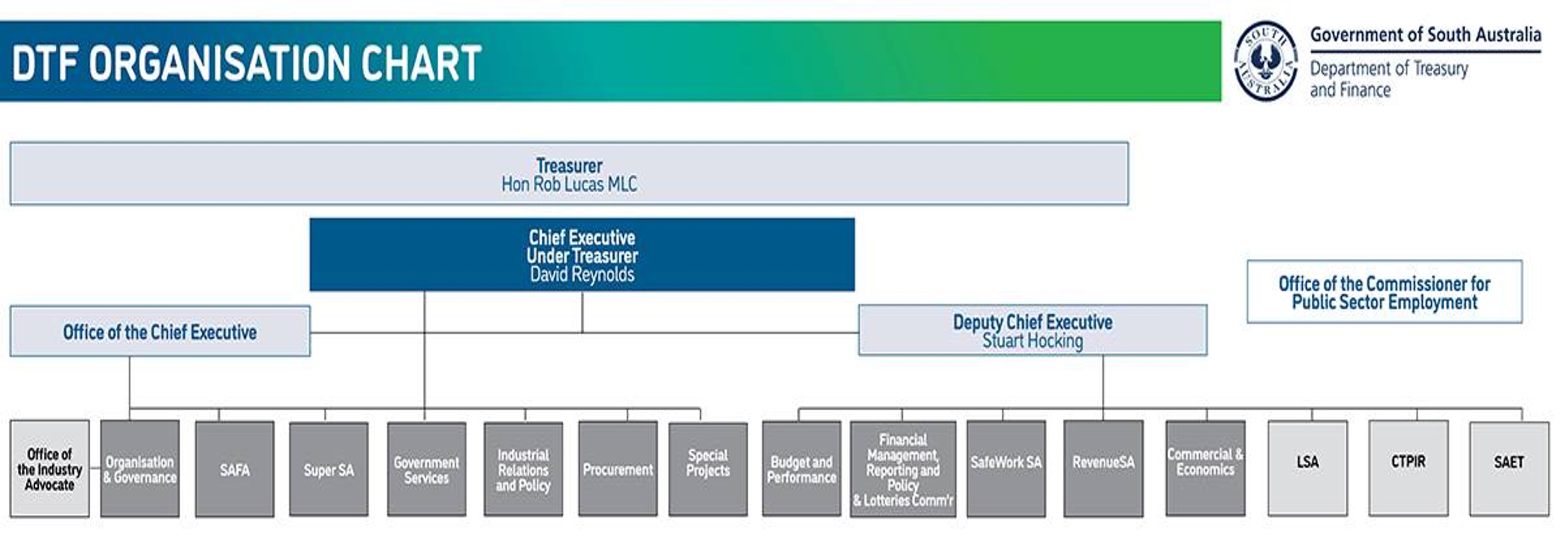

The Department of Treasury and Finance reports to the Treasurer, the Hon Rob Lucas MLC.

Rob Lucas was elected to the Legislative Council in the South Australia in 1982 and has continually served the parliament since that time.

The Minister oversees:

- Finance

- Industrial Relations

- The Public Sector

David Reynolds, Chief Executive

Stuart Hocking, Deputy Chief Executive

Dascia Bennett, Chief Executive, Super SA

Andrew Blaskett, Executive Director, Special Projects

Elbert Brooks, Executive Director, Industrial Relations and Policy

Julie-Anne Burgess, Executive Director, Organisation and Governance

Martyn Campbell, Executive Director, SafeWork SA

Mark Carey, Executive Director, Government Services

Brad Gay, Executive Director, Commercial and Economics

Julie Holmes, Commissioner of State Taxation, Revenue SA

Anna Hughes, General Manager, SAFA

Tammie Pribanic, Executive Director, Budget and Performance

Tracey Scott, Executive Director, Financial Management, Reporting and Policy & South Australian Lotteries Commissioner

Elizabeth Stavreski, Executive Director, Procurement

Note: does not include leadership positions of separate statutory office holders

*Financial Agreement Act 1994

*Supplementary Financial Agreement (Soldiers Settlement Loans) Act 1934

Bank Merger (BankSA and Advance Bank) Act 1996

Bank Mergers (South Australia) Act 1997

Benefit Associations Act 1958

Commonwealth Places (Mirror Taxes Administration) Act 1999

Compulsory Third Party Insurance Regulation Act 2016

Construction Industry Long Service Leave Act 1987

Dangerous Substances Act 1979

Daylight Saving Act 1971

Electricity Corporations (Restructuring and Disposal) Act 1999

Electricity Corporations Act 1994

Emergency Services Funding Act 1998

Employment Agents Registration Act 1993

Essential Services Commission Act 2002

Explosives Act 1936

Fair Work (Commonwealth Powers) Act 2009

Fair Work Act 1994

Financial Sector (Transfer of Business) Act 1999

Financial Transaction Reports (State Provisions) Act 1992

First Home and Housing Construction Grants Act 2000

Government Financing Authority Act 1982

Governors' Pensions Act 1976

Holidays Act 1910

Industry Advocate Act 2017

Interest on Crown Advances and Leases Act 1944

Judges' Pensions Act 1971

Land Tax Act 1936

Late Payment of Government Debts (Interest) Act 2013

Local Government Finance Authority Act 1983

Long Service Leave Act 1987

Motor Accident Commission Act 1992

National Tax Reform (State Provisions) Act 2000

National Wine Centre (Restructuring and Leasing Arrangements) Act 2002

New Tax System Price Exploitation Code (South Australia) Act 1999

Parliamentary Superannuation Act 1974

Payroll Tax Act 2009

Petroleum Products Regulation Act 1995

Police Superannuation Act 1990

Public Corporations Act 1993

Public Finance and Audit Act 1987

Public Sector (Honesty and Accountability) Act 1995

Public Sector Act 2009

Return to Work Act 2014

Return to Work Corporation of South Australia Act 1994

Rural Advances Guarantee Act 1963

SGIC (Sale) Act 1995

Shop Trading Hours Act 1977

South Australian Employment Tribunal Act 2014

South Australian Timber Corporation (Sale of Assets) Act 1996

South Australian Timber Corporation Act 1979

Southern State Superannuation Act 2009

Stamp Duties Act 1923

Standard Time Act 2009

State Bank (Corporatisation) Act 1994

State Lotteries Act 1966

State Procurement Act 2004

Superannuation Act 1988

Superannuation Funds Management Corporation of South Australia Act 1995

TAB (Disposal) Act 2000

Taxation Administration Act 1996

Unclaimed Moneys Act 1891

Urban Renewal Act 1995

Work Health and Safety Act 2012

* Denotes Act of limited application.

The following agencies are within the Treasurer’s area of responsibility. They each publish their own Annual Report.

Office of the Commissioner for Public Sector Employment (OCPSE)

The OCPSE is an attached office to the Department of Treasury and Finance. An attached office is an administrative unit with increased reporting responsibilities and has a Chief Executive appointed by the Premier in accordance with the Public Sector Act 2009. For the OCPSE, being an attached office strengthens its independence.

The Office of the Commissioner for Public Sector Employment (OCPSE) brings together a number of central functions including the statutory responsibilities of the Commissioner for Public Sector Employment, reform and renewal, leadership development, HR policy development and advice, workforce data analysis and strategy development, salary sacrifice, work, health, safety and workers compensation and performance and policy.

OCPSE are not included in the department’s financial statements.

Office of the Industry Advocate

The Office of the Industry Advocate’s (OIA) role is to take action to further the objectives of the South Australian Industry Participation Policy and to build the capability and capacity of businesses based in South Australia to participate in State Government contracts.

OIA are not included in the department’s financial statements.

Compulsory Third Party Regulator

The purpose of the Regulator is to deliver a high-performing competitive CTP Scheme that offers choice, ease and confidence to the South Australian community. The Regulator is established as an independent statutory authority under the Compulsory Third Party Insurance Regulation Act 2016 (the Act). The Regulator’s functions are funded from the administration fee component of the CTP premium paid by motorists upon registration of their motor vehicles. Regulator staff are employed by Department of Treasury and Finance and seconded to the Regulator.

CTP Regulator is included in the department’s financial statements.

South Australian Employment Tribunal

The South Australian Employment Tribunal (SAET) is established under the South Australian Employment Tribunal Act 2014. SAET is a statutory independent tribunal and court that:

- Resolves return to work disputes

- Resolves certain employment and industrial disputes

- Regulated South Australia’s industrial awards, agreements and registers

- Determines work and safety related prosecutions

- Resolves dust disease matters.

Administrative and Corporate support staff are provided by the Department of Treasury and Finance.

SAET is included in the department’s financial statements.

South Australian Government Financing Authority

The purpose of the South Australian Government Financing Authority (SAFA) is to deliver quality, cost effective financial, insurance and fleet management services to clients within the South Australian public sector.

SAFA is a statutory authority constituted as the Under Treasurer under the Government Financing Authority Act 1982 and commenced operations in January 1983.

SAFA is managed by officers assigned from the Department of Treasury and Finance (DTF).

SAFA is included in the department’s financial statements.

Super SA

Super SA is the superannuation provider for South Australian public sector employees. They administer the following schemes:

- Triple S

- Super SA Select

- Lump Sum Scheme

- Pension Scheme

- Super SA Flexible Rollover Product

- Super SA Income Stream

- Parliamentary Superannuation Scheme

- SA Ambulance Service Superannuation Scheme (SAAMB)

- any other super fund established by the SA Government for its employees.

The Super SA Board is responsible for managing the schemes in line with the relevant Acts and legislation, however funds are managed by Funds SA.

Super SA is included in the department’s financial statements.

The agency's performance

The agency performance does not include information relating to agencies that also publish their own Annual Report [1] or Annual Activity Report[2], so as to avoid repetition.

1. Compulsory Third Party Regulator, Office of the Industry Advocate, South Australian Financing Authority (SAFA) and Super SA.

2. SafeWork SA.

During 2020-21 DTF led or supported a range of programs, initiatives and activities to achieve our objectives including:

- Advice to Government on measures to support the State’s economy, including the $4 billion stimulus package announced in response to COVID-19 in the 2020-21 Budget.

- Allocated resources to deliver the Government’s stimulus program as required.

- Processed applications for the Commonwealth Government’s HomeBuilder Grant, a $25 000 grant for building a new home, substantially renovating an existing home, or buying an off the plan/new home.

- Advice to the Government on the implementation of a road user charge for zero and low emission vehicles.

- Delivered the 2020-21 (delayed to November 2020 due to COVID-19) and 2021-22 state budgets.

DTF Chief Executive is a member of the COVID-19 Transition Committee. The Transition Committee was set up to guide the process of both continuing to move out of the COVID-19 health emergency and restore the social and economic health of the State.

DTF has provided policy advice to Government on measures to support the State economy, including the $4 billion stimulus package announced in response to COVID-19 in the 2020-21 Budget.

DTF also monitored stimulus measures including provision of reports to the Budget Cabinet Committee and Chief Executive Council as required.

DTF allocated resources to deliver the Government’s stimulus program as required, including:

- Administration of the Small Business Grants program rounds 1 and 2. The small business grants program delivered $263 million in grants to 21 360 small businesses and not-for-profits impacted by COVID-19.

- COVID-19 Support Fund (formerly the Business and Jobs Support Fund and the Community and Jobs Support Fund).

- DTF is responsible for the Jobs and Economic Growth Fund Governance Group (formerly the Economic and Business Growth Fund Governance Group).

- Administration of the Private Hospital Funding Agreement on behalf of the Minister for Health and Wellbeing. The agreement provided funding support to South Australian private hospitals impacted by COVID-19 enabling access to private hospital facilities, staff and equipment as required through the early stages of the Government’s COVID-19 response. No staff, facilities or equipment were accessed under the agreement. The amount of $26 million was paid to hospitals supporting their financial viability.

- Provided support to a number of agencies in implementing COVD-19 response activities, including managing the disbursement of various grant and other payments, and managing hotel quarantine invoicing and payment receipting.

- Contributed to the State’s economic stimulus strategy through administration of:

- COVID-19 payroll tax relief

- landlord and commercial property owner occupied land tax relief

- Commonwealth HomeBuilder Scheme

- Local Government Infrastructure Partnership Program

Assisted the State Government in establishing emergency funding provisions via the Governor’s Appropriation Fund under the COVID-19 Emergency Response Act 2020.

SafeWork SA collaborated with Safe Work Australia to develop national COVID‑19‑related work health and safety strategies and guidelines to inform persons conducting a business or undertaking and workers of their obligations and options across all industries within Australia.

SafeWork SA continued to support South Australian businesses, workers and workplaces to achieve effective and compliant health and safety outcomes during the COVID-19 disruption by implementing the COVID-19 education campaign and actively updating the SafeWork SA website.

Key objective | Agency’s contribution |

|---|---|

More jobs | Assisted Government in the development and implementation of a range of measures to support businesses, community organisations and jobs as a result of the COVID-19 pandemic. Led the Jobs and Economic Growth Fund Governance Group including advice on the impacts of proposals on industry development and jobs in the state. Negotiated and managed industry assistance contracts on behalf of the Treasurer and other agencies that promoted economic and employment growth for the State. Traineeship program in the offices of Members of the South Australian Parliament delivering up to 60 Traineeship commencements. |

Lower costs | Implemented payroll tax and land tax relief to assist businesses in response to the COVID-19 pandemic. Provided advice to the Government to enable it to continue to set Emergency Services Levy (ESL) bills that deliver at least $90 million in savings to ESL payers each year. Achieved estimated average annual savings to Government of $12.8 million over the life of the new Electricity contract. Maintained and enhanced SAFA’s access to financial and insurance markets. Super SA fees – remain in the most cost-efficient quartile of funds. |

Better Services | The Schools PPP team has continued to progress delivery of two birth to year 12 schools under a Public Private Partnership arrangement at Aldinga and Angle Vale. Highlights over the period include the finalisation of design development and coordination of a large State infrastructure enabling works package which is needed to support the new schools. Construction across both sites is well progressed and on track to meet the target of being open to commence in term 1, 2022. Led negotiations on social impact investment leading to two new child protection services in South Australia; the Newpin family reunification program and the Resilient Families intensive family support service. Transitioning of customer focused paper-based forms to electronic including application and registration forms within SafeWork SA and Revenue SA. Implemented a new phone and workforce management system, to improve customer experience and agency performance in licensing and advisory service delivery in SafeWork SA. A number of initiatives have been progressed in Shared Services SA to provide better services, including: launch of a new website, preparation activities to enable the adoption of e-invoicing and deployment of a new case management system (ServiceNow) to streamline user access requests and other change activities for the key corporate systems managed by Shared Services SA. Net investment returns comparable to Super SA’s six key competitors. On 1 July 2021, the new South Australian Government Procurement Framework came into effect. The new Framework comprises of Treasurer’s Instruction 18 and four policies covering procurement governance, planning, sourcing and contract management. The framework is designed to streamline procurement processes, reduce red tape and costs for both business and government and achieve improved outcomes and value for money through better planning and early industry engagement. Developed and implemented a data management system to deliver a procurement Supplier Pre-Registration system. The System reduces the time and effort for suppliers bidding to SA Government |

Agency objectives | Indicators | Performance |

|---|---|---|

Accountability for Public Sector Resources | Produce and publish the consolidated Government of South Australia financial statements for 2019-20, the 2020-21 Budget and 2021-22 Budget. | Produced and published the consolidated Government of South Australia financial statements for 2019-20, the 2020‑21 Budget on 10 November 2020 (delayed due to COVID-19) and the 2021-22 Budget on 22 June 2021. |

Provide advice to the government to support the state’s economic recovery from COVID-19 and monitor delivery of the government’s economic stimulus package. | Provided advice to the Treasurer to guide the development of priorities for the 2020-21 and 2021‑22 Budgets, including the $4 billion stimulus package announced in response to COVID-19 in the 2020-21 Budget. Monitored implementation of stimulus measures, including monthly reports to the Budget Cabinet Committee and Chief Executive Council as required. | |

Administer a number of the government’s stimulus initiatives, including the Small Business Grant Program to eligible small businesses and sole traders from November 2020 and the Local Government Infrastructure Partnership program. | The Small Business Grant program (Round 2) provided $76.6m in support to over 8400 businesses. The Local Government Infrastructure Partnership Program approved grants for 57 infrastructure projects across 58 councils. The $106.9m in grants will support the delivery of projects with a total value of over $270m | |

Review the government-wide implementation of the new Australian Accounting Standards to improve ongoing financial reporting arrangements and Accounting Policy Statements. | The department supported public authorities with reporting under new Australian Accounting Standards through the establishment of Government-wide accounting policy, delivery of professional development and technical support. | |

Continue to support recovery and rebuilding in affected communities following the 2019-20 bushfires. | Continued to support the recovery and rebuilding in bushfire affected communities through:

Provided advice on the Government’s response to the Royal Commission into National Natural Disaster Arrangements | |

Support the Treasurer with Council on Federal Financial Relations (CFFR) and National Cabinet input to national reforms. | Provided briefings and advice to support the Treasurer when attending monthly Council on Federal Financial Relations and Board of Treasurers meetings. The Treasurer has also been provided with briefings for his role on the National Federation Reform Council, which is an annual meeting of National Cabinet, CFFR and the Australian Local Government Association. | |

Treasury Services: Revenue Collection and Management | Implementation of changes to land tax aggregation and introduction of a trust surcharge from 1 July 2020, including the electronic lodgement of trust and other notification requirements through RevenueSA Online. | Legislative changes came into effect at midnight 30 June 2020. Changes to the IT systems and administrative business practices have been made to implement new company grouping provisions, aggregation changes and a surcharge on certain trusts. |

Implement the government’s three year land tax ex-gratia transition fund to provide relief for taxpayers, who meet certain criteria and have an increase in their land tax assessment as a result of the changes in aggregation of land owned as of 16 October 2019. | 138 applications were lodged, 99 processed and 39 in progress, totalling approximately $719,000 in payments relief from having to pay increased land tax. | |

Implement the government’s five year affordable community housing land tax exemption pilot aimed to provide eligible property owners ex gratia relief equivalent to the value of land tax for up to 100 properties when they rent their property through a registered community housing provider for affordable housing purposes.New guidelines were published on the RevenueSA website on 1 July 2020. | New guidelines were published on the RevenueSA website on 1 July 2020. Three applications have been received to date.. | |

Progress the re-writing of the Stamp Duties Act 1923 into a modern Duties Bill, for the government’s consideration and introduction to parliament. | External consultation on the draft Bill was undertaken with industry representatives from the State Taxes Liaison Group. Submissions received have been considered and where appropriate, included in the Draft Bill. | |

Implement the Commonwealth Government’s HomeBuilder Grant, a $25,000 grant for building a new home, substantially renovating an existing home, or buying an off the plan/new home. | The Commonwealth’s HomeBuilder Grant was announced on 4 June 2020.

Approximately 40% of the Homebuilder Grant applications considered required further information from the applicant prior to assessment. | |

Continue to improve tax compliance through expansion of existing audit programs targeting areas of potential non-compliance and greater use of data analytics. | An application is being used to digitise the case management process for Compliance Services. In addition, with a focus on greater upfront compliance and use of data analytics, RevenueSA is developing a graph model to identify and map potential relationships between previously ungrouped entities for payroll tax and present the information visually to help Investigators with more complex cases. | |

Industrial Relations | Lead the negotiation of public sector enterprise agreements. | New enterprise agreements were finalised for HomeStart Finance, Nurses and Midwives, Adelaide Cemeteries Authority, SA Police, Adelaide Festival Centre Professional and Administration, Adelaide Festival Centre Performing Arts Centre, Forestry SA, SA Water Corporation (variation), State Theatre Company of SA Workshops and Props, West Beach Trust, Return to Work SA and Train Operations. Negotiations commenced or continued for Funds SA, Public Sector Salaried, Public Sector Weekly Paid, SA Ambulance Service, Salaried Medical Officers, South Australian Metropolitan Fire Service, SA Water and TAFE. |

Manage employment-related litigation concerning the public sector and in particular the resolution of industrial disputes and monetary claims. | Managed on behalf of the declared employer, 65 new matters filed with the South Australian Employment Tribunal. They included monetary claims, industrial disputes and interpretation of clauses in Enterprise Agreements, additional compensation matters, and court litigation. | |

Continue to build industrial relations knowledge and skills across the public sector. | Continued to liaise and consult with Chief Executives and agency representatives about various IR matters; and provided advice to Chief Executives and IR/HR personnel concerning IR issues and their management. | |

SafeWork SA | Continue to contribute to the work injury reduction trend in South Australia with firm and fair enforcement of the law. | SafeWork SA continues to undertake compliance, enforcement and education activities to contribute to the national target in the Australian Work Health and Safety Strategy 2012-2022 of a 30% reduction in the incidence rate of claims resulting in one or more weeks off work by 2022. SA is currently exceeding the targeted reduction for the period by 2.2%. |

Government Services: Shared Services | Finalise deployment of a new version of the Basware invoice management system across agencies. | The new version of the Basware invoice management system has been successfully deployed to all in-scope agencies, other than SA Health. The implementation for SA Health will be progressed during 2021-22. |

Commence implementation of an electronic forms solution to streamline current human resources administrative processes. | A pilot implementation of an electronic forms solution to streamline human resources administrative processes is currently being progressed. Subject to success of the pilot, a business case will be developed for the potential rollout of this solution across government. | |

Continue working with SA Health to increase the number of staff electronically rostered and paid via the ProAct system. | Approximately 2,000 additional SA Health staff are now electronically rostered and paid via the ProAct system. | |

Implement a major upgrade of the CHRIS 21 human resource management system to facilitate compliance with the Commonwealth’s single touch payroll legislation. | The CHRIS 21 human resource management system has been successfully upgraded to enable compliance with the Commonwealth’s single touch payroll legislation. | |

| Work with businesses on the adoption of electronic invoicing (e-invoicing) | Shared Services SA has worked with the Commonwealth to progress implementation of e-invoicing capability for the SA Government. | |

| Progress a number of customer service improvement initiatives, including the launch of a new website for Shared Services. | A new website was launched, and the ServiceNow case management system deployed to streamline the management of user access requests, queries, issues and changes relating to the key corporate systems managed by Shared Services SA. | |

Procurement | Continue leading activities to implement the government’s response to the South Australian Productivity Commission (SAPC) and Statutory Authorities Review Committee (SARC) procurement inquiries. | As at 30 June 2021, implemented 54 SAPC recommendations and 11 SARC recommendations. Implementation of the remaining recommendations is underway. |

Progress development of a unified and streamlined procurement policy framework for government to replace the State Procurement Board. The framework will cover all agencies and types of procurement and will be outcome rather than compliance focused and supported by capability development, enhanced performance reporting and data analytics. | The State Procurement Repeal Act 2020 was proclaimed and the State Procurement Board abolished on 1 July 2021. Treasurer’s Instruction 18 Procurement and four new policies covering procurement governance, planning, sourcing and contract management have been implemented and new guidelines developed and published. | |

Complete deployment of a new technology solution to improve the efficiency and effectiveness of procurement and contract management activities. | On 1 July 2021 the SA Government Procurement Activity Reporting System (PARS) was launched. | |

Establish new across government contracts for the supply of aviation services, natural gas, stationery, personal computer and server equipment, network management services, electricity, Esri geospatial software and managed platform services. | Established four new contracts for:

Work on the remaining contracts is continuing. | |

Complete deployment of the Procurement module of the Procurement and Contract Management System (PCMS) to improve the efficiency and effectiveness of procurement activities and reporting. | Deployed the new Procurement module of PCMS to 10 Public Authorities. Further Public Authorities will be included in 2021-22. | |

Electorate Services | Investigate the use of technological solutions to streamline paper-based business processes associated with human resource management. | Timesheets from Assistants to Members of the South Australian Parliament from across the State are lodged and processed electronically. |

Enhance the frequency and comprehensiveness of inductions for members’ office staff. | Individual inductions with all new Office Managers and Trainees have been enhanced with the introduction of online training focussing on WHS for Officers and Workers, Supporting and Managing Mental Health in the Workplace, Cultural Awareness and Security. | |

Promote opportunities for visits to members’ offices to conduct inspections, review compliance with regulatory and policy obligations, and have more direct engagement with staff. | Multi-faceted visits to MP’s offices were successfully implemented combining staff inductions, asset and WHS audits. | |

| Parliamentary Network Services | Develop and gain approval of a new master service level agreement to clearly define the scope and deliverables for the services provided to parliament. | A draft of the key sections of the service level agreement is under review by the Divisions of Parliament. |

Develop a five year ICT Strategic Plan | The key underlying strategies that support the overall 5 year ICT Strategic Plan have been approved. |

- The People & Performance Branch provided significant policy, procedure, and human resource advice to keep DTF employees working as effectively and efficiently as possible during periods of lockdown and restricted activity. They were supported by a significant uplift in mobility of staff through increased use of technology, enabled by the IT Branch.

- The new Aboriginal and Torres Strait Islander Cultural Awareness Development Strategy was launched. This provides opportunities for all employees to increase their cultural understanding of Aboriginal and Torres Strait Islander peoples and to continue to ensure a culturally safe and inclusive workplace.

- DTF’s Equity, Diversity and Inclusion (ED&I) Strategy 2020-23 has been finalised and implementation commenced. This Strategy demonstrates our commitment to an inclusive workplace that reflects the South Australian community that we serve

- DTF released its first Disability Access and Inclusion Plan (DAIP). Our DAIP commits us to promoting the rights of people living with disability and identifies measurable steps DTF will take towards our vision of an accessible and inclusive South Australia based on fairness and respect.

- 2021-2024 Wellbeing for Our People program was launched. This program is designed to support the wellbeing of our employees. Wellbeing is highly individual and this program involves many initiatives, while also promoting individual choice regarding strategies to maximize wellbeing. This program is underpinned by DTF’s core value – Our People.

Program name | Performance |

|---|---|

DTF: Graduate Program | The DTF Graduate Program provides opportunities for Graduates in accounting, finance, commerce and economics to gain exposure in multiple parts of the business. The program focusses on assisting graduates to assimilate into the Public Sector, whilst building their interpersonal and technical skills. In 2020-21 DTF engaged eleven (11) graduates. |

Aboriginal & Torres Strait Islander Employment and Retention Plan | DTF’s goal is to build a diverse and inclusive workplace and become an employer of choice for Aboriginal and Torres |

Equity, Diversity and Inclusion | An Equity, Diversity and Inclusion strategy was developed in 2020 and is currently being implemented. The strategy includes actions to build the inclusivity of all employees including; LGBTIQ, Gender Equality (including White Ribbon Accreditation), Aboriginal and Torres Strait Islander and CALD employees. |

Performance management and development system | Performance |

|---|---|

Our Conversations | DTF employees have Performance Plans in place which are facilitated and documented through the online system OurDevelopment. The formal OurConversation process requires at least two formal conversations between managers and employees per annum. OurConversations is a new approach implemented in 2020-21 which facilitates discussions about flexible working hours, employee wellbeing and key performance activities as a part of the process. |

Program name | Performance |

|---|---|

Wellbeing for Our People | The department launched our program for 2021-2024 and continued to implement a range of Wellbeing for Our People initiatives, focusing on four key areas of ‘Mind’, ‘Body’, ‘Purpose’ and ‘Place’. Our key program Building Personal Resilience was piloted with employees attending from all areas of DTF. Feedback from participants is informing development of the program for implementation across all areas of DTF in the next three years. The Influenza Vaccination Program reported a 13% increase this year. |

COVID-19 Safety Assessment | Our COVID-19 safety assessment conducted by Deloitte, as part of a public sector review, indicated positive results. This occurred with an early and agile response to the pandemic through our Outbreak Management Team, leadership and compliance through simple action-based tools, and a positive approach to learnings and engaging the department through our Transition and Transform Committee. |

Workplace injury claims | 2020-21 | 2019-20 | % Change |

|---|---|---|---|

Total new workplace injury claims | 4 | 6 | -33% |

Fatalities | 0 | 0 | 0 |

Seriously injured workers* | 0 | 0 | 0 |

Significant injuries (where lost time exceeds a working week, expressed as frequency rate per 1000 FTE) | 0 | 3.3 | -100% |

*number of claimants assessed during the reporting period as having a whole person impairment of 30% or more under the Return to Work Act 2014 (Part 2 Division 5)

Work health and safety regulations | 2020-21 | 2019-20 | % Change |

|---|---|---|---|

Number of notifiable incidents (Work Health and Safety Act 2012, Part 3) | 0 | 1 | -100% |

Number of provisional improvement, improvement and prohibition notices (Work Health and Safety Act 2012 Sections 90, 191 and 195) | 0 | 0 | 0% |

Return to work costs** | 2020-21 | 2019-20 | % Change |

|---|---|---|---|

Total gross workers compensation expenditure ($) | 599,193 | 926,.544 | -35% |

Income support payments – gross ($) | 209,435 | 388,372 | -46% |

**before third party recovery

Data for previous years is available at: Department of Treasury and Finance Annual Report statistics - Dataset - data.sa.gov.au

Executive classification | Number of executives |

|---|---|

EXECOF | 1 |

SAES2 | 13 |

SAES1 | 33 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

The Office of the Commissioner for Public Sector Employment has a workforce information page that provides further information on the breakdown of executive gender, salary and tenure by agency.

Financial performance

The following is a summary of the overall financial position of the agency. The information is unaudited. Full audited financial statements for 2020-2021 are attached to this report.

The 2020‑21 comprehensive result of a $9.3 million deficit is $3.8 million lower than the budgeted deficit of $13.1 million. This improvement primarily reflects a lower than budgeted cash alignment transfer to the Consolidated Account ($1.7 million), and upward revaluation of property, plant, and equipment ($0.8 million). A range of smaller variations across the department account for the balance of the favourable variation.

The department’s actual net assets of $12.0 million at 30 June 2021 is $4.5 million higher than budgeted outcome of $7.5 million. This primarily reflects the better than budget comprehensive result for 2020‑21 ($3.8 million).

Statement of Comprehensive Income | 2020-21 Budget $000 | 2020-21 Actual $000 | Variation $000 | 2019-20 Actual $000s |

|---|---|---|---|---|

Total Income | 265 255 | 256 208 | (9047) | 263 232 |

Total Expenses | 278 394 | 266 340 | (12 054) | 264 088 |

Net Result | (13 139) | (10 132) | 3007 | (856) |

Changes in asset revaluation surplus | - | 827 | 837 | - |

Total Comprehensive Result | (13 139) | (9 305) | 3 834 | (856) |

Statement of Financial Position | 2020-21 Budget $000s | 2020-21 Actual $000s | Variation $000s | 2019-20 Actual $000s |

|---|---|---|---|---|

Current assets | 22 368 | 34 382 | 12 014 | 39 292 |

Non-current assets | 72 775 | 64 259 | (8 516) | 67 563 |

Total assets | 95 143 | 98 641 | 3 498 | 106 855 |

Current liabilities | 40 334 | 38 100 | (2 234) | 35 775 |

Non-current liabilities | 47 281 | 48 541 | 1 2 60 | 35 775 |

Total liabilities | 87 615 | 86 641 | (974) | 86 188 |

Net assets | 7 528 | 12 000 | 4 472 | 20 667 |

Equity | 7 528 | 12 000 | 4 472 | 20 667 |

The following is a summary of external consultants that have been engaged by the agency, the nature of work undertaken, and the actual payments made for the work undertaken during the financial year.

Consultancies with a contract value below $10,000 each

Consultancies | Purpose | $ Actual payment |

|---|---|---|

All consultancies below $10,000 each - combined. | Various | 149,900 |

Consultancies with a contract value above $10,000 each

Consultancies | Purpose | $ Actual payment |

|---|---|---|

Deloitte Risk Advisory Pty Ltd | Security review of the user authentication design for the ProAct online self-service module | 10,500 |

Forensic Engineering | Provision of an expert report associated with workplace incident investigation | 10,600 |

RH Advisory | Performance review of the Super SA Board in accordance with the Australian Institute of Superannuation Trustees governance code | 11,000 |

Ernst & Young | Payroll system and process maturity assessment | 12,950 |

Deloitte Risk Advisory Pty Ltd | Penetration and security assessment associated with implementation of Single Touch Payroll (STP) and Intelligent Workflow Forms (IWF) | 14,594 |

Thomson Geer Adelaide | Provision of legal services | 15,124 |

Thomson Geer Adelaide | COVID-19 Business Advisory Group board fees | 15,835 |

RMB Service Group | Provision of expert report associated with workplace incident investigation | 16,042 |

Deloitte Consulting Pty Ltd | Development and costing of a new Super SA financial advice model pursuant to recommendations of the Superannuation Royal Commission | 18,323 |

Payroll Matters Pty Ltd | Provision of technical payroll services relating to the CHRIS-21 reform project | 18,785 |

Expose Data Pty Ltd | Review of Super SA's current data analytics platform and delivery of data platform architecture to meet data and reporting needs and to comply with CPS 234 (APRA Information Security Standard) | 20,434 |

EMA Consulting Pty Ltd | Specialist human resource advice and support for Super SA | 22,316 |

Converge International Inc | Employee Assistance Program - staff coaching and wellbeing sessions | 22,722 |

KROON Technology | Provision of an expert report associated with workplace incident investigation | 22,727 |

Dennison Advisory Pty Ltd | COVID-19 Business Advisory Group board fees | 23,752 |

Payroll Matters Pty Ltd | Provision of technical payroll services | 25,200 |

PriceWaterhouseCoopers | Specialist commercial advice | 25,281 |

Payroll Matters Pty Ltd | Independent audit of individual pay records, associated calculations, relevant legislation and correspondences | 26,000 |

Adastra | Specialist commercial advice | 30,000 |

The NTF Group | Specialist assistance on Super SA reserving strategy and framework | 32,500 |

Brubrior Investments Pty Ltd | COVID-19 Business Advisory Group board fees | 35,001 |

Deloitte Risk Advisory Pty Ltd | High level security architecture review and external web penetration testing across government payroll self serve applications | 35,855 |

Acton Advisory Pty Ltd | General financial advice relating to the Royal Adelaide Hospital | 40,000 |

Deloitte Access Economics | Specialist economic advice | 44,581 |

PriceWaterhouseCoopers | Review of Super SA's insurance delivery model and updates to the Board's insurance superannuation framework and insurance strategy | 46,410 |

Rice Warner Pty Ltd | Review of Super SA's on-premises data analytics platform and requirements for a future state platform and the delivery of data platform architecture | 49,341 |

Mercer Consulting Pty Ltd | Actuarial review of superannuation schemes | 51,920 |

The University Of Adelaide | Technical advice on hazardous substances materials for emergency services | 128,970 |

The University Of Adelaide | Social Impact Investment Bonds analysis | 178,766 |

KPMG | Support for the development of a high level business case for the replacement of the Masterpiece financial management system | 183,078 |

Financial IQ Pty Ltd | Provision of services to support Super SA's strategic product development and the implementation of Choice of Fund and Limited Public Offer | 234,466 |

The NTF Group | Superannuation specialist assistance on various Super SA strategic projects | 235,104 |

Total | 1,658,177 |

Data for previous years is available at: Department of Treasury and Finance Annual Report statistics - Dataset - data.sa.gov.au

See also the Consolidated Financial Report of the Department of Treasury and Finance for total value of consultancy contracts across the South Australian Public Sector.

The following is a summary of external contractors that have been engaged by the agency, the nature of work undertaken, and the actual payments made for work undertaken during the financial year.

Contractors with a contract value below $10,000

Contractors | Purpose | $ Actual payment |

|---|---|---|

All contractors below $10,000 each - combined | Various | 114,678 |

Contractors with a contract value above $10,000 each

Contractors | Purpose | $ Actual payment |

|---|---|---|

Megan Hender | Assistance with facilitation of the South Australian Employment Tribunal strategic plan | 10,400 |

BDO Advisory (SA) Pty Ltd | Expert advice on fringe benefits tax applicability and documentation requirements | 10,487 |

Greencap - NAAPty Ltd | Asbestos testing - sample identification of a residential property | 10,645 |

John Dunnery | Assistance in developing a long‑term support and maintenance agreement for the CaseVision application for the South Australian Employment Tribunal | 11,100 |

Escient Pty Ltd | Support for the development of a high level business case for procurement systems and an analytics program | 11,280 |

Nucleus Media Australia Pty Ltd | Super SA website discovery and technical scoping | 11,696 |

Peoplebank Australia Ltd | Information technology training for the Parliamentary Network Support Group's clients | 12,522 |

Equifax | Provision of safety online advice and support service to Super SA members | 14,000 |

HOOD Sweeney Pty Ltd | Expert taxation advice regarding fringe benefits tax calculations | 14,250 |

Iocane Pty Ltd | Cyber security and Parliamentary Network Services Group specific software safety review | 15,660 |

David Tune | Periodic review of the Board of Treasurers’ objectives, functions, and organisation of the Board of Treasurers and the Secretariat | 16,400 |

BDO Advisory (SA) Pty Ltd | Probity advice for electricity procurements | 16,911 |

ASG Group Limited | Provision of project management services to assist with Super SA's Print and Mail House Services project | 18,960 |

DB Aero Pty Ltd | Tender documentation and writing specifications for aviation tender | 20,344 |

Deloitte Touche Tohmatsu | Assistance with Super SA’s unit pricing target operating model | 21,000 |

Syncsoft | Upgrade of Super SA systems to allow functionality on Windows Server 2016 and SQLServer 2016 | 22,500 |

Chamonix It Management | Assistance with Super SA’s stakeholder relationship management software system | 22,798 |

Bentleys (SA) Pty Ltd | Financial monitoring of builders in relation to the SA Schools public private partnerships (PPP) program. | 25,364 |

IT Sutherland | SafeWork SA annual records archiving program – project management support l | 25,661 |

NB Communications | Super SA intranet replacement | 26,000 |

Biz Hub Australia Pty Ltd | COVID-19 small business grant IT portal support | 27,278 |

Lucid Insights | Development of performance measures and implementation of management reporting using Microsoft Power BI for the South Australian Employment Tribunal | 29,399 |

Andrew Lau Copywriter | Specialist copywriting services for Super SA's website content | 29,673 |

Randstad Pty Ltd | Short term fleet hire maintenance | 30,047 |

Jacobs Group (Aust) Pty Ltd | Cost consultant services for the SA Schools PPP project | 32,253 |

Placard Pty Ltd | Production of high risk work licence photocards | 32,317 |

PriceWaterhouseCoopers | Development of a cyber strategy to support Super SA’s compliance with CPS 234 (APRA Information Security Standard) | 33,263 |

Talent International (SA) Pty Ltd | Transition of the Office of the Commissioner for Public Sector Employment (OCPSE) into the DTF ICT environment following machinery of government changes | 35,211 |

NW & JR Carr T/AS Carrsview | Contract services to support fringe benefits tax year end processes | 40,323 |

The University Of Adelaide | Graduate Development Program training | 43,285 |

CKM Management Solutions Pty Ltd | Management accounting services – support for preparation of agency statement | 43,469 |

The University Of South Australia | Evaluation of the Aspire social impact bond project | 49,868 |

Gray Andreotti Advisory | Provision of specialist commercial advisory services | 56,720 |

KPMG | End of financial year reporting tool support | 59,232 |

Culturalchemy Pty Ltd | Staff training and workshops to build leadership and change management capabilities in Super SA | 71,930 |

KPP Ventures Pty Ltd | Contract management support for the South Australian Government Financing Authority | 87,870 |

Deloitte Risk Advisory Pty Ltd | Annual security assurance review and security assessment for Shared Services systems | 90,061 |

Honjo Pty Ltd | Project management services – electricity procurement | 97,721 |

Objective Corporation Ltd | Technical support for the Objective records management system | 112,000 |

Episerver | Provision of website hosting and content management services for Super SA | 116,113 |

BDO Advisory (SA) Pty Ltd | Probity advisor to various projects managed by the Commercial and Economics Branch | 124,242 |

Optus Billing Services Pty Ltd | Professional services for the implementation of a new telephone system for SafeWork SA | 129,970 |

SRA Information Technology Pty Ltd | Ongoing development, implementation and maintenance of SafeWork SA’s Infonet system | 130,703 |

Aurecon Australasia Pty Ltd | SA Schools PPP Project - Technical Advisor | 134,448 |

Between Pty Ltd | Information technology support for the South Australian Government Financing Authority | 152,702 |

Lane Print Group | Provision of printing and dispatch services | 153,860 |

Deloitte Risk Advisory Pty Ltd | Super SA internal Audit Services | 154,473 |

Nerkle Business Modelling | Management accounting services | 160,355 |

Escient Pty Ltd | Software development for the Essential Services Commission of South Australia | 168,233 |

KPMG | Provision of financial due diligence in relation to the Emergency Bushfire Concessional Loans Scheme | 169,199 |

KPMG | Taxation advice on Super SA's statutory obligations | 169,720 |

Bravura | Upgrade of Super SA's ePASS system | 174,697 |

Opex Nominees Pty Ltd | Support development of a new procurement framework and associated policies and guidance documents | 177,022 |

Empired Ltd | Design and implementation of a new Super SA corporate website | 193,124 |

WT Partnership | Independent reviewer for the SA Schools PPP project | 202,588 |

KPMG | COVID-19 small business grant assessment system and process support | 249,163 |

PriceWaterhouseCoopers | Departmental internal audit services | 260,950 |

Australia Post | Provision of payment processing services for RevenueSA | 272,632 |

Enclave Project Delivery | SA Schools PPP Project - Project Director | 316,069 |

Financial IQ Pty Ltd | Advisory services on the strategic product development and the implementation of Super SA's Choice of Fund and Limited Public Offer projects | 390,566 |

SS&C | Statement of Works for the Bluedoor system | 514,445 |

Commonwealth Bank of Australia | Provision of payment processing services for RevenueSA | 556,020 |

Industry Fund Services Pty Ltd | Financial planning services for Super SA members and presentations at Super SA seminars | 788,044 |

Fujitsu Australia Ltd | Revenue SA system support and application management services | 1,528,291 |

Total | 8,727,527 |

Data for previous years is available at: Department of Treasury and Finance Annual Report statistics - Dataset - data.sa.gov.au

The details of South Australian Government-awarded contracts for goods, services, and works are displayed on the SA Tenders and Contracts website. View the agency list of contracts.

The website also provides details of across government contracts.

Risk Management

DTF remains committed to ensuring that effective risk management is at the core of all activities. DTF’s aim is to ensure that risk management is embedded in decision-making, processes and culture, contributing to the achievement of its strategic objectives and creation of a positive organisational risk culture.

DTF is committed to using a ‘three lines of defence’ model for managing risk. The model helps inform the Executive, Risk and Performance Committee and senior management how well risk management functions are operating and establishes responsibilities for risks and controls.

DTF’s Risk Management Framework provides the components and inputs required to demonstrate effective risk management is embedded at all levels of the organisation.

The agency continued to manage risks through online systems and tools, conducting a number of monitoring reviews in key risk areas, co-ordinating year-end assurance processes to support the preparation of DTF’s financial statements, and a comprehensive review of the strategic risk register.

The Risk and Performance Committee is responsible for providing high-level oversight of DTF’s Risk Management Framework and how it is implemented. It has surveillance of key strategic risks identified by DTF’s Executive. The Committee has no responsibility for managing risks but has a responsibility to provide assurance to the Chief Executive that the Risk Management Framework remains relevant and robust.

The Committee’s role, responsibilities and scope are defined in its Terms of Reference, which was reviewed and updated in October 2020.

In 2020-21, the Committee conducted a number of activities related to financial statements, risk management, audit and internal controls, most notably:

- Oversight of DTF’s Strategic Plan and Corporate Governance Framework from a risk management perspective.

- Review and discussion of DTF’s IT risks and controls

- Review and oversight of DTF’s extreme and high risks

- Review and consideration of risks related to the impacts of the COVID-19 pandemic on DTF’s operations and staff working arrangements

- Endorsement of DTF’s Strategic Risk Register

- Endorsement of DTF’s Conflicts of Interest Policy

- Endorsement of DTF’s Payment Card Industry Compliance Policy

- Consideration of customer complaint systems and data across DTF

- Consideration of the operations of key DTF branches, including SafeWork SA, Super SA and Revenue SA

- Oversight of DTF’s protective security, business continuity and emergency management policies and procedures

- Endorsement of DTF’s Security Plan

- Endorsement of DTF’s Risk Appetite Statement

- Consideration of risk in the context of the State Budget outcomes.

In 2021-22, the Committee will continue to focus on providing assurance to the Chief Executive by monitoring and overseeing DTF’s risk and control frameworks, internal and external audit issues and external accountability requirements. Specific attention will be given to DTF’s 12 strategic risks, as well as emerging risks.

Category/nature of fraud | Number of instances |

|---|---|

Timesheet fraud | 1 |

Phishing incident | 1 |

NB: Fraud reported includes actual and reasonably suspected incidents of fraud.

DTF is committed to the prevention, detection and control of fraud, corruption, maladministration and misconduct in connection with the Department’s activities. DTF has a zero-tolerance approach to fraud, corruption or other criminal conduct, maladministration and misconduct. DTF is committed to minimising the incidence of fraud and corruption through sound financial, legal and ethical decision-making and organisational practices. The principles of honesty and integrity consistent with the Code of Ethics for the South Australian Public Sector are promoted.

DTF’s Fraud and Corruption Policy and Control Framework provide DTF’s processes for identifying and responding to fraud risk. These documents were reviewed and updated in October 2020.

DTF’s branches maintain and review their fraud risk register to ensure any new fraud risks are managed and controls are identified and implemented. The Risk, Audit and Security team provides oversight of fraud risks and controls documented in the register.

Detection, control and prevention activities include:

- Disclosure by staff of suspected or actual fraudulent behaviour

- Review of transaction reports

- Review of management reports

- Data analysis

- Conflict of interest declarations

- Gifts and benefits arrangements

- Employee screening

- Confidentiality arrangements

- Internal and external audits

- Appropriate segregation of duties

- Financial policies and procedures

- Post incident review of internal controls

- Financial year end declaration processes

- Mandatory fraud and corruption awareness training for new and existing employees. A new fraud training module was developed and rolled out in September 2020.

Data for previous years is available at: Department of Treasury and Finance Annual Report statistics - Dataset - data.sa.gov.au

Number of occasions on which public interest information has been disclosed to a responsible officer of the agency under the Public Interest Disclosure Act 2018:

One (1)

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

Note: Disclosure of public interest information was previously reported under the Whistleblowers Protection Act 1993 and repealed by the Public Interest Disclosure Act 2018 on 1/7/2019.

Public complaints

Number of public complaints reported

Complaint categories | Sub-categories | Example | Number of Complaints 2020-21 |

|---|---|---|---|

Professional behaviour | Staff attitude | Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency | 10 |

Professional behaviour | Staff competency | Failure to action service request; poorly informed decisions; incorrect or incomplete service provided | 6 |

Professional behaviour | Staff knowledge | Lack of service specific knowledge; incomplete or out-of-date knowledge | 0 |

Communication | Communication quality | Inadequate, delayed or absent communication with customer | 64 |

Communication | Confidentiality | Customer’s confidentiality or privacy not respected; information shared incorrectly | 29 |

Service delivery | Systems/technology | System offline; inaccessible to customer; incorrect result/information provided; poor system design | 75 |

Service delivery | Access to services | Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities | 3 |

Service delivery | Process | Processing error; incorrect process used; delay in processing application; process not customer responsive | 95 |

Policy | Policy application | Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given | 45 |

Policy | Policy content | Policy content difficult to understand; policy unreasonable or disadvantages customer | 163 |

Service quality | Information | Incorrect, incomplete, out dated or inadequate information; not fit for purpose | 5 |

Service quality | Access to information | Information difficult to understand, hard to find or difficult to use; not plain English | 2 |

Service quality | Timeliness | Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met | 26 |

Service quality | Safety | Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness | 0 |

Service quality | Service responsiveness | Service design doesn’t meet customer needs; poor service fit with customer expectations | 8 |

No case to answer | No case to answer | Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate | 13 |

Investments (Super SA specific) | Investments | Investment fees; Dissatisfaction with investment of assets | 7 |

Total | 551 |

Additional Metrics | Total |

|---|---|

Shared Services SA: | |

Number of positive feedback comments | 33 |

Number of negative feedback comments | 1 |

Total number of feedback comments | 34 |

% complaints resolved within policy timeframes | 75% |

Safework SA: | |

Number of positive feedback comments | 16 |

Number of negative feedback comments | 11 |

Total number of feedback comments | 27 |

% complaints resolved within policy timeframes | 66% |

Super SA: | |

Number of positive feedback comments | 49 |

Number of negative feedback comments | 33 |

Total number of feedback comments | 82 |

% complaints resolved within policy timeframes | 80% |

Revenue SA: | |

Number of positive feedback comments | 19 |

Number of negative feedback comments | 0 |

Total number of feedback comments | 19 |

% Complaints resolved within policy timeframes | 83% |

Data for previous years is available at:

https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

Service Improvements |

|---|

During 2020-21 PwC undertook an audit of DTF’s customer feedback and complaints management system. The audit identified issues for management to address including improvements to the complaint escalation process and strengthening of related policies and procedures. Escalation processes have been addressed through the formalisation of existing requirements for Branch Heads to notify the Office of the Chief Executive of significant complaints or concerns. Service Improvements made by individual DTF Branches resulting from complaints or consumer suggestions over 2020-21 are set out below |

Shared Services SA: Shared Services has implemented a new Complaint Management System to improve the visibility and tracking of complaints across the business. This system includes workflow functionality to ensure accuracy/quality control of information and provides real time reporting of complaint status and associated actions. The system also requires the completion of a review process for each complaint to capture root cause analysis and identify continuous improvement opportunities |

Safework SA: All complaints/feedback received are reported monthly to the SafeWork SA Governance, Risk and Audit Committee for noting and escalation of any trends identified. SafeWork SA received complaints from clients primarily due to:

Improvements: Reviews of licencing processes, and complaints relating to licencing delays have resulted in the identification of opportunities to improve processing timelines. |

Super SA: The office introduced Key Performance Indicators which included a target for decreasing complaints. Super SA introduced new values to adhere to in order to provide a better service to our members. Updated the delegations to allow particular senior staff to extend the time limit for submission of insurance appeals lodged outside of the three month period, rather than it requiring a Board decision. Improved wording in some letters and on the member online portal to alert members of important information and timing of lodgements. Continuous enhancements to the administration system. |

Revenue SA: Revenue SA continues to explore opportunities to modernise service delivery and improve business efficiencies. The following enhancements have been implemented:

|

Compliance Statement

Department of Treasury and Finance is compliant with Premier and Cabinet Circular 039 – complaint management in the South Australian public sector. | Yes |

Department of Treasury and Finance has communicated the content of PC 039 and the agency’s related complaints policies and procedures to employees. | Yes |

Appendix: Audited Financial Statements 2020-21

Audited Financial Statements 2020-21 (PDF 17.8MB)