This annual report will be presented to Parliament to meet the statutory reporting requirements of Public Sector Act 2009 and the requirements of Premier and Cabinet Circular PC013 Annual Reporting.

This report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Submitted on behalf of the Department of Treasury and Finance by:

David Reynolds

Chief Executive

Under Treasurer

Overview: about the agency

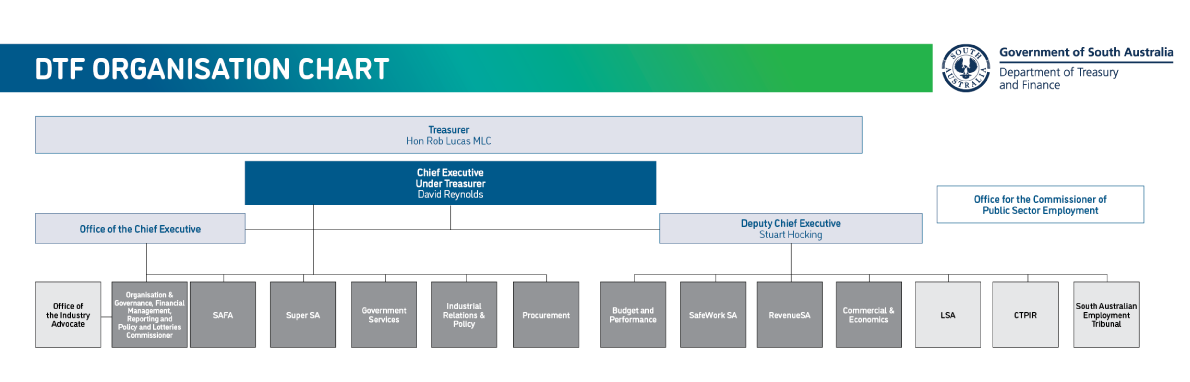

During 2019-20 there were the following changes to the agency’s structure and objectives as a result of internal reviews or machinery of government changes.

- Transferred into Department of Treasury and Finance from 1 July 2019 from Department of Health and Wellbeing

- Health Financial Accounting and Taxation Services (HATS)

- Transferred into Department of Treasury and Finance from 1 January 2020

- Lotteries Commission of South Australia.

- Transferred into Department of Treasury and Finance from 1 December 2019

- Oracle Debt Management Receipting (ODMR) from Department of Health and Wellbeing

- Following internal structure reviews:

- Accounting Services moved to report to Executive Director Organisation and Governance and changed name to Financial Management Reporting and Policy

The Department of Treasury and Finance reports to the Hon Rob Lucas MLC, Treasurer of South Australia.

David Reynolds, Chief Executive

Stuart Hocking, Deputy Chief Executive

Tracey Scott, Acting Executive Director, Organisation and Governance, Financial Management, Reporting and Policy & South Australian Lotteries Commissioner

Anna Hughes, General Manager, SAFA

Dascia Bennett, Chief Executive, Super SA

Mark Carey, Executive Director, Government Services

Elbert Brooks, Executive Director, Industrial Relations and Policy

Elizabeth Stravreski, Executive Director, Procurement

Tammie Pribanic, Executive Director, Budget and Performance

Martyn Campbell, Executive Director, SafeWork SA

Julie Holmes, Commissioner of State Taxation, Revenue SA

Brad Gay, Executive Director, Commercial and Economics

Trudy Minett, A/Chief Executive, Lifetime Support Authority

Kim Birch, Chief Executive, CTP Insurance Regulator

Erma Ranieri, Commissioner for Public Sector Employment, Office of the Commissioner for Public Sector Employment

Leah McLay, Registrar, South Australian Employment Tribunal

Ian Nightingale, Industry Advocate, Office of the Industry Advocate

Bank Merger (BankSA and Advance Bank) Act 1996

Bank Mergers (South Australia) Act 1997

Benefit Associations Act 1958

Commonwealth Places (Mirror Taxes Administration) Act 1999

Compulsory Third Party Insurance Regulation Act 2016

Construction Industry Long Service Leave Act 1987

Dangerous Substances Act 1979

Daylight Saving Act 1971

Electricity Corporations Act 1994

Electricity Corporations (Restructuring and Disposal) Act 1999

Emergency Services Funding Act 1998

Employment Agents Registration Act 1993

Essential Services Commission Act 2002

Explosives Act 1936

Fair Work Act 1994

Fair Work (Commonwealth Powers) Act 2009

*Financial Agreement Act 1994

Financial Sector (Transfer of Business) Act 1999

Financial Transaction Reports (State Provisions) Act 1992

First Home and Housing Construction Grants Act 2000

Government Financing Authority Act 1982

Governors' Pensions Act 1976

Holidays Act 1910

Industry Advocate Act 2017

Interest on Crown Advances and Leases Act 1944

Judges' Pensions Act 1971

Land Tax Act 1936

Late Payment of Government Debts (Interest) Act 2013

Local Government Finance Authority Act 1983

Long Service Leave Act 1987

Motor Accident Commission Act 1992

National Tax Reform (State Provisions) Act 2000

National Wine Centre (Restructuring and Leasing Arrangements) Act 2002

New Tax System Price Exploitation Code (South Australia) Act 1999

Parliamentary Superannuation Act 1974

Payroll Tax Act 2009

Petroleum Products Regulation Act 1995

Police Superannuation Act 1990

Public Corporations Act 1993

Public Finance and Audit Act 1987

Public Sector Act 2009

Public Sector (Honesty and Accountability) Act 1995

Return to Work Act 2014

Return to Work Corporation of South Australia Act 1994

Rural Advances Guarantee Act 1963

SGIC (Sale) Act 1995

Shop Trading Hours Act 1977

South Australian Employment Tribunal Act 2014

South Australian Timber Corporation Act 1979

South Australian Timber Corporation (Sale of Assets) Act 1996

Southern State Superannuation Act 2009

Stamp Duties Act 1923

Standard Time Act 2009

State Bank (Corporatisation) Act 1994

State Lotteries Act 1966

State Procurement Act 2004

Superannuation Act 1988

Superannuation Funds Management Corporation of South Australia Act 1995

*Supplementary Financial Agreement (Soldiers Settlement Loans) Act 1934

TAB (Disposal) Act 2000

Taxation Administration Act 1996

Unclaimed Moneys Act 1891

Urban Renewal Act 1995

Work Health and Safety Act 2012

* Denotes Act of limited application

Office of the Commissioner for Public Sector Employment (OCPSE)

The Office of the Commissioner for Public Sector Employment (OCPSE) brings together a number of central functions including the statutory responsibilities of the Commissioner for Public Sector Employment, reform and renewal, leadership development, HR policy development and advice, workforce data analysis and strategy development, salary sacrifice, work, health, safety and workers compensation performance.

The OCPSE is an attached office to the Department of Treasury and Finance. An attached office is an administrative unit with increased reporting responsibilities and has a Chief Executive appointed by the Premier in accordance with the Public Sector Act 2009. For the OCPSE, being an attached office strengthens its independence.

South Australian public sector agencies and employees provide many essential services to the community and OCPSE works with them to help them to deliver their best.

The agency's performance

During 2019-20 DTF led or supported a range of programs, initiatives and activities to achieve our objectives including:

- Assisted the government to respond to the bushfires and COVID-19 pandemic by providing:

- Policy advice

- Implementation of systems

- Administration of applications and payments of bushfire and COVID-19 relief measures.

- Implementing changes to land tax.

- Progressing the Schools PPP project, a private public partnership involving construction of two birth to year 12 schools in South Australia.

- Established a Secretariat based in Adelaide to support the Board of Treasurers.

- Modernised service delivery in Revenue SA.

- Conducted procurements to replace a number of major across government contracts, including voice and unified communications, electricity, Microsoft licensing and distributed computing services.

- Consulted with government agencies to progress the development of a new procurement framework for the public sector.

- Undertook industry consultation and an independent review into the Stamp Duties Act.

- Led the negotiation of expiring public sector enterprise agreements.

- Actively responded to the Commonwealth Government's COVID-19 Early Release of Superannuation Benefits initiative, to assist members suffering financial hardship due to COVID-19. As at 30 June 2020, 5,500 Triple S members had their applications for the early release of benefits approved and paid.

Key objective | Agency’s contribution |

|---|---|

More jobs |

|

Lower costs |

|

Better Services |

|

Agency objectives | Indicators | Performance |

|---|---|---|

Accountability for Public Sector Resources | Produce and publish the consolidated Government of South Australia financial statements for 2018-19, the 2019-20 MYBR and the 2020-21 Budget. | Published 2018‑19 financial statements and the 2019‑20 MYBR. The 2020‑21 Budget will be released on 10 November 2020 to reflect estimated impacts of COVID-19 on the state’s finances. |

Assist the government to respond to the independent inquiry into water pricing in South Australia. | The independent inquiry into water pricing in South Australia concluded on 30 June 2019. Consistent with the findings of the inquiry, the Government revised down the value of SA Water’s water regulated asset base by $520 million (in 2012 dollars). This formed part of the Essential Services Commission of South Australia’s SA Water Regulatory Determination for the period from 1 July 2020 to 30 June 2024. The Determination provides for a significant reduction in household water use prices. | |

Assist in the negotiation of a new National Health Reform Agreement between the States and the Commonwealth Government by 30 June 2020. | Contributed to the successful negotiation of the National Health Reform Agreement which was signed by the Premier on 29 May 2020. | |

Assist the government to effectively manage assets used in the delivery of Vocational Education and Training (VET) services to the community. | Managed the process to transfer ownership of State-owned infrastructure assets used for the delivery of VET services from Renewal SA to TAFE SA. | |

Assist the Government implementing reforms to the Land Tax Act 1936. | Provided policy advice to the Government to assist in implementing significant land tax reforms. | |

Lead the South Australian response to the Commonwealth Grants Commission’s review of the methodology used to distribute GST revenue between jurisdictions, the 2020 Methodology Review. | Led the response to the Review, which determines the distribution of GST between jurisdictions, and provided advice to the Government on the implications of the outcome. | |

Establish a permanent Secretariat based in Adelaide to support the Board of Treasurers. | Provided advice on a range of issues considered by the Board of Treasurers. | |

Continue to lead the assessment of the impacts of new Australian Accounting Standards at a whole of government level and develop appropriate drafting instructions required for amendments to the Treasurer’s Instructions (Accounting Policy Statements). | DTF has continued its efforts in developing government wide policy for the implementation of the new Accounting Standards. Amendments have been made to the Treasurer’s Instructions (Accounting Policy Statements) to reflect government-wide policy decisions. | |

Lead the development of amendments to the Unclaimed Moneys Act 1891 in accordance with the Project Agreement on Small Business Regulatory Reform between the South Australian and the Commonwealth Governments. | Preliminary stakeholder consultation was undertaken to inform the development of a draft amendment Bill. | |

Progress the delivery of new birth to Year 12 education facilities to be built under a public private partnership in the Angle Vale region and Sellicks Beach/Aldinga region in close collaboration with the Department for Education. | Concluded the appointment of TESA Education to deliver the schools. Commenced the design development phase, site establishment and preparation works, with all design packages expected by the end of September 2020. | |

Treasury Services: Revenue Collection and Management | Improve payroll tax compliance through expansion of existing audit programs targeting areas of potential non-compliance. | Audit program expanded to include emphasis on:

Working in collaboration with Department of Infrastructure and Transport (DIT), Revenue SA is undertaking an education program for major infrastructure contractors regarding payroll tax obligations to improve upfront compliance. |

Implement changes to land tax aggregation and introduce a trust surcharge with effect from 1 July 2020. | Letters sent to all non-exempt landowners advising of new notification requirements. Changes to the IT systems and administrative business practices were made to implement new company grouping provisions, aggregation changes and a surcharge on certain trusts. | |

Implement enhancements to online services, including a review of the online Stamp Duty Conveyance process to integrate it with mandated third-party reporting data collection. | The Commonwealth mandatory third-party reporting data has been integrated with the stamp duty lodgement process to improve the customer experience and minimise the burden on practitioners when providing the data. A land tax module within RevenueSA Online system has been implemented to facilitate the changes to land tax legislation. In excess of 190,000 landowners have successfully accessed the system to notify of land holdings. | |

Support the market entry of additional electronic lodgement network operators into South Australia to service stamp duty practitioners. | RevenueSA has supported the entrance of a second Electronic Lodgement Network Operator, Sympli. Sympli is now operationally ready to onboard practitioners in South Australia for the purposes of eConveyancing. | |

Implement further measures to modernise service delivery. | RevenueSA continues to explore opportunities to modernise service delivery and improve business efficiencies. The following enhancements have been implemented:

| |

Commence re-drafting of the Stamp Duties Act 1923 (SA) to simplify, modernise and structure in a manner consistent with duties act models adopted in the majority of other states and territories. | External consultation on the draft Bill was undertaken with industry representatives from the State Taxes Liaison Group. Submissions received have been considered by RevenueSA and Parliamentary Counsel. | |

Treasury Services: Treasury, Insurance and Fleet Services | Continue to broaden SAFA’s profile and penetration with investors to enable cost-effective refinancing of existing short and long-term debt. | SAFA’s long-term funding task for 2019-20 was reduced to $3.0 billion from $3.2 billion following the release of the MYBR. As a result of the bushfires on Kangaroo Island and at Cudlee Creek, the COVID-19 pandemic and the postponement of the 2020-21 State Budget, SAFA’s borrowing’s in 2019-20 was larger than the $3.0 billion reported in the MYBR, with $5.2 billion in term funding being raised. The funding was raised through the issue of a mixture of short and long-term debt from domestic financial markets. |

Renew the government’s reinsurance program. | The government’s reinsurance program was successfully renewed in 2019-20 at a total cost of $9.8 million ($8.9 million in 2018-19). The increase in premium was a result of changing insurance market conditions. | |

Establish new arrangements for the provision of fleet management and vehicle disposal management of the government fleet. | New arrangements for the provision of fleet management and vehicle disposal services for the government fleet have been established, with contracts being executed with the service providers in August 2019. | |

Treasury Services: Superannuation Services | Undertake a default investment option review in conjunction with Funds SA. | Strategic review completed. Updates have been made to the default Balanced investment option for the Triple S, Select and Flexible Rollover Product, as well as Lump Sum Scheme member component Growth option. During the reporting period, for the Balanced Option, the allocation to growth assets has risen from 65 per cent to 70 per cent and has a long-term growth assets target of 75 per cent. |

Perform a review of insurance services to align with insurance code of conduct. | Super SA has commenced a review aimed at ensuring Super SA’s insurance service and product offering is contemporary as the fund moves into a competitive environment. Super SA’s insurance service model review will also ensure the product suite is future-proofed, de-risked, responds to members’ needs, is fit for purpose and meets members’ expectations. Conforming to the Commonwealth’s retirement income policy and meeting APRA’s standards, as well as aligning with certain Insurance Code of Conduct provisions as per obligations under the Heads of Government Agreement (HOGA), are key objectives. | |

Conduct a review of the contact centre and modernise the telephony system. | Technical requirements and procurement of a system vendor for a new Contact Centre Solution have been completed. The new technology will be cloud-based offering enhanced functionality to enable improved workforce optimisation and flexibility, better reporting capability and a superior member experience. Implementation of the new solution is on track to occur in 2020. | |

Industrial Relations | Lead the negotiation of expiring public sector enterprise agreements. | New enterprise agreements were finalised for public sector nurses and midwives; employees at SA Water; teachers, school support and ancillary employees at government schools and preschools; tram employees; employees at Adelaide Venue Management Corporation; plumbing, metal and building trades employees in the public sector; and Assistants to the Members of the SA Parliament. Negotiations commenced or continued for the following enterprise agreements: South Australia Police; State Theatre Company (Workshops and Props); South Australian Ambulance Service; TAFE SA Educational Staff; South Australia Metropolitan Fire Service; South Australian Modern Public Sector: Salaried; Forestry SA; Rail Commissioner-Train Operations (Federal jurisdiction), South Australian Public Sector Wages Parity: Weekly Paid; Adelaide Festival Centre Trust-Performing Arts; Adelaide Festival Centre Trust – Professional and Administration; West Beach Trust. |

Manage employment-related litigation concerning the public sector and in particular the resolution of industrial disputes and monetary claims. | Managed, on behalf of the declared employer, 51 new matters filed with the South Australian Employment Tribunal. They included monetary claims, industrial disputes and interpretation of clauses in Enterprise Agreements, additional compensation matters; and court litigation. | |

Continue to build industrial relations knowledge and skills across the public sector. | Continued to liaise and consult with chief executives and agency representatives about various IR matters; and provided advice to chief executives and IR/HR personnel concerning IR issues and their management. | |

SafeWork SA | Contribute to the work injury reduction trend in South Australia. | SafeWork SA continues to undertake compliance, enforcement and education activities to contribute to the national target in the Australian Work Health and Safety Strategy 2012-2022 of a 30% reduction in the incidence rate of claims resulting in one or more weeks off work by 2022. SA is currently exceeding the targeted reduction for the period by 5%. |

Provide consistent and practical services to support businesses and workers to improve work health and safety and workplace relations outcomes, including making it easier for people to engage with SafeWork SA and taking firm and fair action in the case of non-compliance. | SafeWork SA undertook 12,046 compliance and enforcement visits and 32,660 education, engagement and support activities for 2019-20 to support businesses and workers improve their work health and safety and industrial relations outcomes. | |

Implement changes arising from the Independent Commissioner Against Corruption (ICAC) evaluation. | There were 39 ICAC recommendations made. As at 30 June 2020, 15 recommendations have been completed and 24 are in progress. | |

Government Services: Shared Services | Progress implementation of an electronic forms solution to streamline current human resources administrative processes. | A pilot implementation of an electronic forms solution within the CHRIS 21 human resource management system is underway in conjunction with SA Police. Subject to the outcomes of the pilot, a business case will be developed for the potential deployment of this solution across government. |

Work with the Department for Health and Wellbeing to increase the number of staff electronically rostered and paid via the ProAct system, significantly reducing the need for the submission of manual timesheets and leave requests. | During 2019-20, an additional 1,765 SA Health employees were transitioned to be electronically rostered and paid via the ProAct system. | |

Implement a major upgrade of the CHRIS 21 human resource management system to facilitate compliance with the Commonwealth’s single touch payroll legislation. | Planning and testing activities for a major upgrade of CHRIS 21 have been completed. Implementation of the upgrade, including adoption of the Commonwealth’s single touch payroll legislation is scheduled to occur progressively between August and December 2020. | |

Progress deployment of a new version of the Basware invoice management system across government agencies. | As at 30 June 2020, the new version of the Basware invoice management system has been deployed to approximately 1,500 users across six agencies. | |

Whole of Government Procurement | Conduct procurements to replace a number of major across government contracts. | During 2019-20, across government procurements were progressed for voice and unified communications, electricity, Microsoft licensing and distributed computing services. New Microsoft licensing and support contracts were executed prior to 30 June. Finalisation of new contracts for voice and unified communications, electricity and distributed computing services are scheduled for completion before 31 December 2020. |

Deliver a new training and certification program for procurement professionals across government. | A new procurement Capability Development Strategy was drafted and endorsed by agency Heads of Procurement. | |

Develop an updated policy framework in response to the outcomes of the SA Productivity Commission government procurement inquiry and to State/Commonwealth legislative changes. | Significant work has been undertaken including:

| |

Electorate Services | Relocate further electorate offices affected by the 2016 Electoral Districts Boundaries Commission redistribution of electoral boundaries. | New Electorate Offices were established within redistributed Electoral District Boundaries for MacKillop, Colton, Mawson, Reynell and Wright electorates. Suitable accommodation options for Lee and Black Electorate Offices have been identified. |

Continue to build productive working relationships with cross agency and third-party providers that support the delivery of services to members of the South Australian Parliament. | Working collaboratively with the DIT, delivered five new Electorate Offices and are working towards the development of a standard minimum specification for Electorate Offices. Collaborated with vehicle agents / suppliers in the replacement of the ageing Ministerial Chauffeur fleet vehicles with modern, fuel efficient, fit for purpose with high safety rating vehicles. |

During 2019-20 Organisation and Governance Branch:

- Launched new DTF Intranet significantly improving fast access to relevant staff information.

- Launched the DTF Gender Equality and Respect Action Plan.

- Delivered nine actions and promoted various resources as part of the DTF Wellbeing for Our People program.

- Implemented new contemporary online induction program providing vital information for new employees.

- Established a COVID-19 Outbreak Management Team to assess risks. Safe workplace plan implemented in line with advice from Department of Health and SafeWork Australia.

- Improved business continuity through the implementation of a stable and cost-effective remote IT Access Service to better support working from home arrangements.

- Implemented new Risk Management Framework.

Program name | Performance |

|---|---|

DTF: Graduate Program | DTF provides a range of graduate opportunities across the department, including the DTF Graduate Program. DTF coordinates the South Australian Government Graduate Development Program for Graduates in accounting, finance, commerce and economics. The program targets the development of core interpersonal skills in addition to technical skills and provides participants with the opportunity to apply their learning directly to government specific examples and activities. In 2020, DTF engaged seven participants in the program. |

DTF: Coaching Program | The DTF Coaching Program commenced in October 2019 with 14 senior leaders completing the program. The program delivered development opportunities to build capacity to take on more senior or complex roles. |

DTF: Mentoring Program | The DTF Mentoring Program commenced in October 2019 with 34 mentees commencing partnerships with internal mentors. The program was designed to build the capability, self-confidence and opportunities for the mentees. It also assisted the participants in their personal development and career planning. |

Reconciliation Action Plan | During 2019-20:

|

Performance management and development system | Performance |

|---|---|

Performance Discussions | 100% of DTF employees have Performance Discussions which are facilitated and documented through the online learning management system. The formal Performance Discussion process is biannual and focusses on engaging with our people and building relationships. |

Program name | Performance |

|---|---|

Wellbeing for Our People | The department continued to implement a range of Wellbeing for Our People initiatives, focusing on four key areas of ‘Mind’, ‘Body’, ‘Purpose’ and ‘Place’. While some scheduled events were suspended during the peak of the COVID-19 pandemic a range of innovative topics and delivery methods were introduced with a key focus on psychological wellbeing over this time. An increase of 10% in flu vaccinations was reported as part of the department Influenza Vaccination Program, with additional appointments including a drive-thru service on offer this year. |

Mental Health First Aid | In line with the provisions of the SA Modern Public Sector Enterprise Agreement – Salaried 2017, the Mental Health First Aid Training Program achieved the target number of participations by Designated First Aiders, Health and Safety Representatives and other workers. |

Deloitte Self-Insurer Audit and Verification System (AVS) results | The Department’s WHS&IM system was found to be performing at the maturity level of ‘Proactive’ for the domain of Safety Leadership and ‘Safety Leader’ for the domains of Wellbeing & Engagement and Performance Measurement. |

Executive classification | Number of executives |

|---|---|

EXECOF | 1 |

SAES2 | 13 |

SAES1 | 32 |

Non-SAES Executive | 8 |

Acting Executive | 2 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

The Office of the Commissioner for Public Sector Employment has a workforce information page that provides further information on the breakdown of executive gender, salary and tenure by agency.

Financial performance

The following is a brief summary of the overall financial position of the agency. While the 2019-20 Budget information shown below is not subject to audit, the actuals information reflects the disclosures in the department’s audited 2019-20 financial statements attached to this report.

The 2019-20 net result of a $0.856 million deficit is $0.730 million lower than the budgeted operating deficit of $1.586 million. This improvement reflects a range of small variations across the department.

The department’s actual net assets of $20.667 million at 30 June 2020 is $18.964 million lower than budgeted outcome of $39.631 million. This largely reflects the transfer of the South Australian Integrated Land Information system (SAILIS) service concession asset ($17.062 million) to the former Department for Planning, Transport, and Infrastructure (DPTI) pursuant to 1 July 2018 machinery of government changes. This transfer was not reflected in the 2019-20 Budget.

Statement of Comprehensive Income | 2019-20 Budget | 2019-20 Actual | Variation | 2018-19 Actual |

|---|---|---|---|---|

Total Income | 237 810 | 263 232 | 25 422 | 321 854 |

Total Expenses | 239 396 | 264 088 | (24 692) | 322 062 |

Net Result | (1 586) | (856) | 730 | (208) |

Total Comprehensive Result | (1 586) | (856) | 730 | (208) |

Statement of Financial Position | 2019-20 Budget | 2019-20 Actual | Variation | 2018-19 Actual |

|---|---|---|---|---|

Current assets | 37 588 | 39 292 | 1 704 | 39 401 |

Non-current assets | 89 883 | 67 563 | (22 320) | 63 198 |

Total assets | 127 471 | 106 855 | (20 616) | 102 599 |

Current liabilities | 49 592 | 35 775 | (13 817) | 29 640 |

Non-current liabilities | 38 248 | 50 413 | 12 165 | 47 210 |

Total liabilities | 87 840 | 86 188 | (1 652) | 76 850 |

Net assets | 39 631 | 20 667 | 18 964 | 25 749 |

Equity | 39 631 | 20 667 | 18 964 | 25 749 |

The following is a summary of external consultants that have been engaged by the agency, the nature of work undertaken, and the actual payments made for the work undertaken during the financial year.

Consultancies with a contract value below $10,000 each

Consultancies | Purpose | $ Actual payment |

|---|---|---|

All consultancies below $10,000 each - combined | Various | 80,987 |

Consultancies with a contract value above $10,000 each

Consultancies | Purpose | $ Actual payment |

|---|---|---|

ACCRU Harris Orchard | Process review of insurance within Super SA | 24,000 |

Athena IOC | Review and updates for Super SA unit pricing management guidelines | 76,500 |

BBB Advisory | Super SA call centre review | 42,200 |

Bentleys | Specialised taxation advice for the South Australian Housing Authority relating to GST for development sales and transfers | 30,750 |

Bentleys (SA) Pty Ltd | Commercial advice on the tax structure of trusts associated with the 2019 Land Tax reforms | 25,000 |

Brubrior Investments Pty Ltd | COVID-19 Business Advisory Group board fees | 38,389 |

Converge International Inc | Employee Assistance Program | 22,963 |

Deloitte | HR21 system penetration & vulnerability assessment | 35,921 |

Deloitte | Creation of a financial advice model for Super SA | 80,708 |

Deloitte Access Economics | Economic and Business Growth fund – economic assessment of proposals | 148,796 |

Dennison Advisory Pty Ltd | COVID-19 Business Advisory Group board fees | 19,793 |

Ernst & Young | General Accounting advice relating to the new Royal Adelaide Hospital | 17,681 |

Ernst & Young | Lease accounting advice and associated financial modelling in relation to the new Royal Adelaide Hospital | 35,898 |

Ernst & Young | Comparison of the new Royal Adelaide Hospital abatement regime with other relevant projects nationally and associated advice | 58,297 |

Financial IQ Pty Ltd | Super SA Insurance Program Manager costs | 58,803 |

HealthConsult | Independent review of fees paid to medical practitioners engaged by the South Australian Employment Tribunal | 20,000 |

KPMG | Review of the Concessional Bushfire Loans Scheme | 16,385 |

KPMG | Financial modelling advice for Public Private Partnerships | 29,738 |

KPMG | Super SA culture and brand review | 225,236 |

Kroon Technology | Professional engineering services for the investigation of workplace incidents | 55,809 |

Payroll Matters Pty Ltd | Provision of technical payroll services | 25,200 |

PriceWaterhouseCoopers | DTF risk and audit services | 30,105 |

PriceWaterhouseCoopers | Actuarial services ensuring Super SA’s compliance with state and federal reporting requirements | 45,000 |

PriceWaterhouseCoopers | Super SA insurance strategy and future delivery options | 66,000 |

PriceWaterhouseCoopers | Land Tax model methodology review project | 69,689 |

Sense of Security Pty Ltd | Security testing of Super SA’s ePASS system and Bluedoor IT infrastructure | 22,100 |

The NTF Group | Ongoing superannuation specialist assistance for Super SA | 119,763 |

The University Of Adelaide | Estimating inflation expectations for regulatory decisions | 13,425 |

The University Of Adelaide | Technical advice on hazardous substances materials for emergency services | 137,155 |

Thomson Geer Adelaide | COVID-19 Business Advisory Group board fees | 23,752 |

Tridant Pty Ltd | Cognos system support | 10,079 |

Total | 1,625,135 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

See also the Consolidated Financial Report of the Department of Treasury and Finance for total value of consultancy contracts across the South Australian Public Sector.

The following is a summary of external contractors that have been engaged by the agency, the nature of work undertaken, and the actual payments made for work undertaken during the financial year.

Contractors with a contract value below $10,000

Contractors | Purpose | $ Actual payment |

|---|---|---|

All contractors below $10,000 each - combined | Various | 97,149 |

Contractors with a contract value above $10,000 each

Contractors | Purpose | $ Actual payment |

|---|---|---|

Acuity Partners Pty Ltd | Procurement support services | 36,463 |

Arcblue Consulting (Aus) Pty Ltd | Benchmarking Report for SA Government stationery pricing | 33,146 |

Aurecon Australasia Pty Ltd | SA Schools PPP project - Technical Advisor | 558,819 |

Australia Post | Provision of payment processing services | 321,116 |

BDO Advisory (SA) Pty Ltd | Probity advice for Super SA's Insurance project | 10,506 |

BDO Advisory (SA) Pty Ltd | SSSA FBT policy and procedure development | 16,531 |

BDO Advisory (SA) Pty Ltd | Probity advice for electricity procurements | 68,494 |

BDO Advisory (SA) Pty Ltd | Probity advisor to various projects managed by the Commercial Projects Group | 168,857 |

Bentleys (SA) Pty Ltd | Domiciliary equipment service AS-IS process mapping | 38,083 |

Between Pty Ltd | Critical IT support for the South Australian Government Financing Authority | 145,471 |

BIZ Hub Australia Pty Ltd | COVID-19 small business grant IT portal support | 69,289 |

Bravura Ecommerce Solutions Pty Ltd | Upgrade of the Super SA ePass system | 11,179 |

CBA | Provision of payment processing services | 694,879 |

CKM Management Solutions Pty Ltd | Management accounting services | 31,406 |

Codium Pty Ltd | Stage 1- Discovery Stage: Data Analytics Strategy and Roadmap | 29,970 |

Consolidated Tenders Services | Tender Systems maintenance services between SATC and DTF | 50,000 |

Contour Management | COVID-19 tenancy floor plans detailing workplace area and social distancing principles | 10,400 |

Deloitte | Security assessment of the Basware New Generation application | 35,700 |

Deloitte | Strategic review of Scope Global | 39,782 |

Deloitte | Super SA internal audit services | 232,891 |

Deloitte | Super SA cyber security review | 20,090 |

EBMS Pty Ltd | Development of a contract management system (Nimblex) for Strategic Procurement | 266,740 |

Enable Professional Services | Implementation of ServiceNow software | 129,532 |

Enclave Project Delivery | SA Schools PPP project - Project Director | 392,854 |

Ernst & Young | Super SA taxation services | 62,155 |

Ernst & Young | SA Schools PPP project- input to market sounding, risk register, RfP and EOI process | 443,543 |

Fujitsu Australia Ltd | Interim support and application management services | 1,605,071 |

Funds SA | Local funds management - evaluation and strategy selection | 42,300 |

GAAP Consulting | Provision of accounting masterclass sessions | 11,210 |

Honjo Pty Ltd | Project management services - electricity procurement | 248,601 |

Industry Fund Services Pty Ltd | Financial planning services for Super SA members and presentations at Super SA seminars | 44,649 |

Investec Australia Limited | Commercialisation advice – Motor Vehicle Registration project | 32,679 |

IT Sutherland | Annual records archiving program - project management support | 35,927 |

Jacobs Group (Aust) Pty Ltd | SA Schools PPP project - Cost Consultant | 42,798 |

Key Energy & Resources Pty Ltd | Electricity procurement support | 21,015 |

KPMG | Taxation advice on Super SA's statutory obligations | 72,167 |

KPMG | End of Financial Year reporting tool support | 102,656 |

KPMG | State Procurement Board lead reviewer program | 146,708 |

KPMG | COVID-19 small business grant assessment system and process support | 315,238 |

KPMG | Accounting and tax advice for Land Services commercialisation | 341,696 |

Lane Print Group | Provision of printing and dispatch services | 311,316 |

MPH Architects | SA Schools PPP project - Technical Advisor | 112,390 |

Nerkle Business Modelling | Management accounting services | 104,538 |

Nucleus Media Australia Pty Ltd | Website discovery and technical scoping | 11,455 |

NW & JR Carr T/AS Carrsview | Contract services to support FBT year end processes | 25,056 |

On:Creative | Development of branding for Procurement Services SA | 12,000 |

Opex Nominees Pty Ltd | Development of the new procurement framework and associated policies and guidance documents | 129,162 |

Oracle CMS | Revenue SA telephone call centre services | 66,260 |

Placard Pty Ltd | Production of High Risk Work Licence photocards | 26,522 |

PriceWaterhouseCoopers | Review of BCP documents and workshop | 10,835 |

PriceWaterhouseCoopers | Departmental internal audit services | 152,531 |

PriceWaterhouseCoopers | Small Business Grants - advice and assistance | 175,988 |

PriceWaterhouseCoopers | Financial advisory services for SAHMRI2 building | 179,152 |

Randstad Pty Ltd | Short term fleet hire maintenance | 39,728 |

Rice Warner Pty Ltd | Super SA insurance strategy and future delivery options | 18,350 |

Rigby Downs Consulting | Schools PPP project – technical financial advice | 20,385 |

Rixstewart Pty Ltd | SA Schools PPP project - Facilities Management Advisor | 76,237 |

Square Holes | Review and test of payroll tax exemption communications, publications and system design with small business stakeholders | 14,375 |

SRA Information Technology Pty Ltd | Ongoing development, implementation and maintenance of SafeWork SA’s Infonet system | 177,532 |

SWOOD Financial Solutions Pty Ltd | Transition and creation of agencies in the masterpiece financial system | 32,400 |

The University Of Adelaide | Graduate Development Program training | 13,674 |

Thomas Project Management | Project management services for SA Government Mainframe Transition project | 47,856 |

Unico Computer Systems Pty Ltd | Commercial agreement, benefit realisation and transition of Super SA systems | 50,700 |

WT Partnership | Independent review of the SA Schools PPP project | 96,128 |

Total | 8,885,181 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

The details of South Australian Government-awarded contracts for goods, services, and works are displayed on the SA Tenders and Contracts website. View the agency list of contracts.

The website also provides details of across government contracts.

Risk Management

DTF remains committed to ensuring that effective risk management is at the core of all its activities. DTF’s aim is to ensure that risk management is embedded in its decision-making, processes and culture, contributing to the achievement of its strategic objectives and creation of positive organisational risk culture.

DTF is committed to using a ‘three lines of defence’ model for managing risk. The three lines of defence model helps inform the Executive, Risk and Performance Committee and senior management how well risk management functions are operating and establishes responsibilities for risks and controls.

In 2019-20 DTF progressed development and implementation of a new Risk Management Framework. The Framework provides the components and minimum requirements DTF is required to meet and implement to demonstrate effective risk management is embedded throughout DTF at all levels.

The agency continued to manage its risks through online systems and tools, conducted a number of monitoring reviews in key risk areas, co-ordinated year-end assurance processes to support the preparation of DTF’s financial statements, conducted a major review of its strategic risks and developed a Risk Appetite Statement.

Internal Audit

Independent assurance of the adequacy and effectiveness of risk management within DTF is provided by DTF’s Internal Auditor, who reports to the Executive Director, Organisation and Governance, and the Risk and Performance Committee.

The audits outlined in our 2019-20 Internal Audit Plan were delivered with no major issues identified.

Risk and Performance Committee

The Risk and Performance Committee (the Committee) is responsible for providing high-level oversight of the Framework and how it is implemented. It has oversight of key enterprise risks identified by DTF’s Executive. The Committee has no responsibility for managing risks but has a responsibility to review the Framework to provide assurance to the Chief Executive that it remains relevant and robust. The Committee’s role, responsibilities and scope are defined in its Terms of Reference.

In 2019-20, the Committee conducted a number of activities related to financial statements, risk management, audit and internal controls. In 2021, the Committee will continue to focus on providing assurance to the Chief Executive by monitoring and overseeing DTF’s risk and control frameworks, internal and external audit issues and external accountability requirements.

Category/nature of fraud | Number of instances |

|---|---|

Nil |

DTF is committed to the prevention, detection and control of fraud, corruption, maladministration and misconduct in connection with the Department’s activities.

DTF has a zero-tolerance approach to fraud, corruption or other criminal conduct, maladministration and misconduct. DTF is committed to minimising the incidence of fraud and corruption through sound financial, legal and ethical decision-making and organisational practices and promotes the principles of honesty and integrity consistent with the Code of Ethics for the South Australian Public Sector.

DTF’s Anti-Fraud and Corruption Policy and Anti-Fraud and Corruption Control Strategy provide DTF’s processes for identifying and responding to fraud risk. DTF’s branches maintain and review their fraud risk register at branch level to ensure any new fraud risks are managed and controls are identified and implemented. The Risk, Audit and Security team provides oversight of fraud risks and controls documented in the register.

Detection, control and prevention activities include:

- Disclosure by staff of suspected or actual fraudulent behaviour

- Reviews of transaction reports

- Review of management reports

- Data analysis

- Internal and external audits

- Appropriate segregation of duties

- Financial policies and procedures

- Review of internal controls post incident

- Financial year end declaration processes

- Fraud and corruption awareness training for new and existing employees.

Data for previous years is available at: Department of Treasury and Finance Annual Report statistics - Dataset - data.sa.gov.au

Number of occasions on which public interest information has been disclosed to a responsible officer of the agency under the Public Interest Disclosure Act 2018:

Two

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

Note: Disclosure of public interest information was previously reported under the Whistleblowers Protection Act 1993 and repealed by the Public Interest Disclosure Act 2018 on 1/7/2019.

Reporting required under the Carers’ Recognition Act 2005

Nil

Public complaints

Complaint categories | Sub-categories | Example | Number of Complaints 2019-20 |

|---|---|---|---|

Professional behaviour | Staff attitude | Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency | 9 |

Professional behaviour | Staff competency | Failure to action service request; poorly informed decisions; incorrect or incomplete service provided | 9 |

Professional behaviour | Staff knowledge | Lack of service specific knowledge; incomplete or out-of-date knowledge | 3 |

Communication | Communication quality | Inadequate, delayed or absent communication with customer | 69 |

Communication | Confidentiality | Customer’s confidentiality or privacy not respected; information shared incorrectly | 7 |

Service delivery | Systems/technology | System offline; inaccessible to customer; incorrect result/information provided; poor system design | 266 |

Service delivery | Access to services | Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities | 2 |

Service delivery | Process | Processing error; incorrect process used; delay in processing application; process not customer responsive | 134 |

Policy | Policy application | Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given | 40 |

Policy | Policy content | Policy content difficult to understand; policy unreasonable or disadvantages customer | 92 |

Service quality | Information | Incorrect, incomplete, out dated or inadequate information; not fit for purpose | 13 |

Service quality | Access to information | Information difficult to understand, hard to find or difficult to use; not plain English | 2 |

Service quality | Timeliness | Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met | 30 |

Service quality | Safety | Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness | 0 |

Service quality | Service responsiveness | Service design doesn’t meet customer needs; poor service fit with customer expectations | 54 |

No case to answer | No case to answer | Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate | 25 |

Investments (Super SA specific) | Investments | Investment fees; Dissatisfaction with investment of assets | 22 |

Total | 777 |

Additional Metrics | Total |

|---|---|

Shared Services SA: | |

Number of positive feedback comments | 16 |

Number of negative feedback comments | 1 |

Total number of feedback comments | 17 |

% complaints resolved within policy timeframes | 92% |

Safework SA: | |

Number of positive feedback comments | 8 |

Number of negative feedback comments | 4 |

Total number of feedback comments | 12 |

% complaints resolved within policy timeframes | 60% |

Super SA: | |

Number of positive feedback comments | 48 |

Number of negative feedback comments | 0 |

Total number of feedback comments | 48 |

% complaints resolved within policy timeframes | 78% |

Revenue SA: | |

Number of positive feedback comments | 8 |

Number of negative feedback comments | 0 |

Total number of feedback comments | 8 |

% Complaints resolved within policy timeframes | 92% |

Data for previous years is available at:

https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

Service Improvements resulting from complaints or consumer suggestions over 2019-20 |

|---|

Shared Services SA:

|

Safework SA:

|

Super SA:

|

Revenue SA:

|

Audited Financial Statements 2019-20 (PDF 3.3MB)