This annual report will be presented to Parliament to meet the statutory reporting requirements of Public Sector Act 2009 and Fines Enforcement and Debt Recovery Act 2017 and the requirements of Premier and Cabinet Circular PC013 Annual Reporting.

This report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Submitted on behalf of the Department of Treasury and Finance by:

Rick Persse

Under Treasurer

From the Under Treasurer

Throughout 2022-23, the department continued to play our key advisory role to government, providing analysis and advice on a range of financial, economic and policy matters.

The department played a leading role in coordinating an across government response to the state’s housing challenge with the development of the “Our Better Housing Future” policy and associated initiatives contained in the state’s budget, published in June.

The department also advised on cost-of-living challenges, including partnering with the Commonwealth and Department of Human Services to introduce the Energy Bill Relief Program announced in the state budget.

The department has worked closely with the Treasurer of South Australia and the South Australian Government to prepare the 2022-23 Mid-Year Budget Review and 2023-24 Budget, with key government initiatives implemented in a fiscally responsive manner. It was pleasing that the state’s credit rating was recently reaffirmed by rating agencies, including Standard and Poor’s announcement to revise South Australia’s long term credit rating outlook from negative to stable.

We have continued to focus on developing the capability of our staff to ensure the department meets our key priorities. In April this year we released a new 5-year strategic plan aimed at ensuring the department is a high performing agency providing world class analysis, services and advice.

This year has also seen some additional machinery of government changes, as Parliamentary Network Support Group transitioned to the Joint Parliamentary Service. Finally, I would like to thank staff across the agency for their dedication and hard work this year. We’ve accomplished a great deal towards our goal to help South Australia be a thriving, prosperous State now and in the future.

Rick Persse

Under Treasurer

Department of Treasury and Finance

Overview: about the agency

Our Purpose | In April 2023, DTF launched our strategic plan with a new purpose. The new purpose provides alignment with the South Australian public sector purpose, but provides specificity to the work of Treasury and Finance. ‘We work to ensure South Australia is a thriving, prosperous state now and into the future.’ |

|---|---|

Our Priorities | Economic prosperity Fiscal sustainability Service excellence Contemporary leadership Compelling advice World class Treasury and Finance |

| Our Values | In addition to the public sector values, the department has a number of specific values that inform our culture. |

Our functions, objectives, and deliverables | The Department of Treasury and Finance is the lead agency for economic, social and financial policy outcomes. We play a vital role in providing financial services to the community and economic and fiscal policy advice to the Government of South Australia. Our people also provide corporate and business services in the areas of payroll, accounts payable, accounts receivable and financial services so that all South Australian government departments can focus on their core business operations. Our people provide direct services to members of the public. We deliver these through three programs:

|

Treasury and Finance (DTF) consists of the following business areas:

- Budget and Performance

- Commercial and Economics Compulsory Third Party Regulator*

- Information and Technology

- Financial Management Reporting and Policy

- Fines Enforcement and Recovery Unit

- Lifetime Support Authority*

- People and Performance Procurement Services SA

- Priority Reforms

- Revenue SA

- SA Government Financing Authority*

- Shared Services SA

- Super SA*

*These agencies submit their own annual report to government.

During 2022-23 Parliamentary Network Support Group moved to Joint Parliamentary Service as part of machinery of government changes.

As a result of administrative arrangements described in the Government Gazette on 30 June 2022, Safework SA, the South Australian Employment Tribunal and Industrial Relations transferred from the department to the Attorney General's Department. The effective date of the transfer was 1 July 2022.

In addition, some staff transferred out of the department to support the Office of Hydrogen Power of South Australia (OHPSA).

The Treasurer is the Hon. Stephen Mullighan MP.

Rick Persse, Under Treasurer

Tammie Pribanic, Deputy Under Treasurer

Scott Bayliss, Chief Services Officer

Dascia Bennett, Chief Executive, Super SA

Andrew Blaskett, Chief Recovery Officer, Fines Enforcement and Recovery Unit

Tricia Blight, Executive Director, Budget and Performance

Mark Carey, Executive Director, Shared Services SA

Anthony Coates, Chief Executive, South Australian Financing Authority (SAFA)

Brad Gay, Executive Director, Commercial and Economics

Julie HolmesCommissioner of State Taxation, Revenue SA

Tracey ScottExecutive Director, Financial Management Reporting and Policy and South Australian Lotteries Commissioner

Prema OsborneDirector, People and Performance

Elizabeth Stavreski Executive Director, Procurement

Note: does not include leadership positions of separate statutory office holders

Bank Merger (BankSA and Advance Bank) Act 1996

Bank Mergers (South Australia) Act 1997

Benefit Associations Act 1958

Commonwealth Places (Mirror Taxes Administration) Act 1999

Compulsory Third Party Insurance Regulation Act 2016

Electricity Corporations Act 1994

Electricity Corporations (Restructuring and Disposal) Act 1999

Emergency Services Funding Act 1998

*Financial Agreement Act 1994

Financial Sector (Transfer of Business) Act 1999

Financial Transaction Reports (State Provisions) Act 1992

Fines Enforcement and Debt Recovery Act 2017

First Home and Housing Construction Grants Act 2000

Government Financing Authority Act 1982

Governors' Pensions Act 1976

Industry Advocate Act 2017

Interest on Crown Advances and Leases Act 1944

Judges' Pensions Act 1971

Land Tax Act 1936

Late Payment of Government Debts (Interest) Act 2013

Local Government Finance Authority Act 1983

Motor Accident Commission Act 1992

Motor Vehicle Accidents (Lifetime Support Scheme) Act 2013

National Tax Reform (State Provisions) Act 2000

National Wine Centre (Restructuring and Leasing Arrangements) Act 2002

New Tax System Price Exploitation Code (South Australia) Act 1999

Parliamentary Superannuation Act 1974

Payroll Tax Act 2009

Treasurer Petroleum Products Regulation Act 1995

Police Superannuation Act 1990

Public Corporations Act 1993

Public Finance and Audit Act 1987

Rural Advances Guarantee Act 1963

SGIC (Sale) Act 1995

South Australian Timber Corporation Act 1979

South Australian Timber Corporation (Sale of Assets) Act 1996

Southern State Superannuation Act 2009

Stamp Duties Act 1923 Treasurer State Bank (Corporatisation) Act 1994

State Lotteries Act 1966

Superannuation Act 1988

Superannuation Funds Management Corporation of South Australia Act 1995

*Supplementary Financial Agreement (Soldiers Settlement Loans) Act 1934

TAB (Disposal) Act 2000

Taxation Administration Act 1996

Unclaimed Moneys Act 1891

* Denotes Act of limited application

The following agencies are within the Treasurer’s area of responsibility. They each publish their own Annual Report.

Lifetime Support Authority

The Lifetime Support Authority (LSA) delivers the Lifetime Support Scheme (LSS), which was established under the Motor Vehicle Accidents (Lifetime Support Scheme) Act 2013.

Through the LSS, the LSA funds necessary and reasonable treatment, care and support for people who sustain serious injuries in a motor vehicle accident on South Australian roads, regardless of fault.

The LSA commenced operations on 1 July 2014 and is a statutory authority governed by an independent Board of Directors and a Chief Executive.

LSA is not included in the department’s financial statements.

Office of the Industry Advocate

The Office of the Industry Advocate’s (OIA) role is to take action to further the objectives of the South Australian Industry Participation Policy and to build the capability and capacity of businesses based in South Australia to participate in State Government contracts.

OIA is not included in the department’s financial statements.

Compulsory Third Party Regulator

The purpose of the Regulator is to deliver a high-performing competitive CTP Scheme that offers choice, ease, and confidence to the South Australian community.

The Regulator is established as an independent statutory authority under the Compulsory Third Party Insurance Regulation Act 2016 (the Act). The

Regulator’s functions are funded from the administration fee component of the CTP premium paid by motorists upon registration of their motor vehicles. Regulator staff are employed by Department of Treasury and Finance and seconded to the Regulator.

CTP Regulator is not included in the department’s financial statements.

South Australian Government Financing Authority

The purpose of the South Australian Government Financing Authority (SAFA) is to deliver quality, cost effective financial, insurance and fleet management services to clients within the South Australian public sector.

SAFA is a statutory authority constituted as the Under Treasurer under

the Government Financing Authority Act 1982 and commenced operations in January 1983.

SAFA is managed by officers assigned from the Department of Treasury and Finance . SAFA, the statutory authority, is not included in the department’s financial statements.

Super SA

Super SA is a dedicated superannuation fund for South Australian public sector workers. They administer the following:

- Triple S Scheme

- Pension Scheme

- Lump Sum Scheme

- Income Stream

- Flexible Rollover Product

- SA Ambulance Service Superannuation Scheme

- Super SA Select

- Judges Pension Scheme

- Governors Pension Scheme

- Parliamentary Superannuation Scheme

The Super SA Board, the Southern Select Super Corporation and the Parliamentary Superannuation Board is responsible for managing these schemes in line with the relevant Acts and legislation, however funds are managed by Funds SA.

Super SA’s dedicated superannuation fund is not included in the department’s financial statements.

The agency's performance

The agency produced and published the 2022-23 Mid-Year Budget Review, and the 2023-24 Budget.

The agency provided advice to government on a broad range of economic and social policy matters, including the government’s housing policies and approach to deliver on its commitments under the National Housing Accord and various cost of living relief measures.

The agency continues to contribute to a number of high priority reforms, including the University Merger, the state’s first indigenous expenditure report, Closing the Gap, the Early Childhood Education Royal Commission and the introduction of three year- old preschool.

DTF has also contributed to government priority projects including advisory and financing support for the new Women and Children’s Hospital, relocation of the SAPOL barracks away from the Adelaide Parklands to other locations, and the North-South Corridor Torrens to Darlington project.

In May 2023, the agency launched our new Stretch Reconciliation Action Plan. This is the work of many across the agency, and our first Stretch plan, which reflects our ongoing objective of embedding our reconciliation practices as business as usual within the department.

| Agency objectives | Indicators | Performance |

|---|---|---|

| Accountability for public sector resources | Produce and publish the consolidated Government of South Australia financial statements for the 2021-22, the 2022-23 Mid-Year Budget Review, and the 2023-24 Budget. | Produced and published the 2021-22 Final Budget Outcome, the 2022-23 MYBR and the 2023-24 Budget. |

| Accountability for public sector resources | Continue to provide comprehensive secretariat support and advice to the Board of Treasurers. |

Co-ordinated Board of Treasurers meetings and agenda papers.

Provided briefings and advice to support the Treasurer. |

| Accountability for public sector resources | Provide advice to the Treasurer on issues and national reforms to be considered by the Council on Federal Financial Relations. | Provided briefings and advice to support the Treasurer when attending Council on Federal Financial Relations and Board of Treasurers meetings. |

| Accountability for public sector resources | Continue to provide advice to government on a broad range of government economic and social policy matters. | Provided advice on a broad range of government economic and social policy matters, including the government’s housing policies and approach to deliver on its commitments under the National Housing Accord. |

| Accountability for public sector resources | Continue to provide advice on the impact of changes to legislation governing the Commonwealth Government’s distribution of GST revenue between jurisdictions and potential reform options. | Provided advice on the impact of changes to legislation governing the Commonwealth Government’s distribution of GST revenue between jurisdictions and potential reform options. |

| Accountability for public sector resources | Continue to support recovery and rebuilding in disaster affected communities. |

Provided financial and budgetary advice to the Government on River Murray flood event, including the financial assistance package and insurance claims management.

Assessed and managed claims for financial assistance from councils through the Local Government Disaster Recovery Assistance Arrangements. |

| Accountability for public sector resources | Continue to provide commercial and contract management support to the Department for Education (DFE) through the defects liability period for the new birth to year 12 education facilities in Angle Vale and Aldinga built under a public- private partnership, which expires in April 2024, 24 months after final acceptance. | Continued to support the DFE in its ongoing contract management role, attended project steering committee meetings, and provided commercial and contractual advice where required. DTF led, on behalf of DFE, the refinancing of the project in 2022. |

| Accountability for public sector resources | Continue to coordinate the state’s role in supporting construction of the new Australian Bragg Centre for proton therapy cancer treatment and research due for completion in late 2023. | Administered the grant and reporting for SAHMRI to ensure delivery of the ProTom machine under the Commonwealth Government under the National Partnership Agreement. |

| Accountability for public sector resources | Implement the contract for government-wide transactional and merchant banking services and purchase card services following tender processes. |

Completed for the following departments: Department of Treasury and Finance (Corporate), Lifetime Support Authority, SAFA, and establishment of the Treasurer’s set-off arrangements.

Purchase card arrangements have been retained with ANZ for all government agencies. |

| Accountability for public sector resources | Continue to review and modernise the Treasurer’s instructions as issued under the Public Finance and Audit Act 1987. | Ongoing |

| Treasury services: Revenue Collection and Management | Finalise payments to eligible homeowners under the Commonwealth Government’s HomeBuilder Grant Scheme by 30 June 2023. |

A total of 14 082 applications have been received with 11 817

paid as at 30 June 2023 |

| Treasury services: Revenue Collection and Management | Continue development of taxpayer facing system interfaces to facilitate a better customer experience. | Ongoing improvements to the revenue management systems continue. Improvements in 22-23 include the ability for conveyancers to self-determine stamp duty on the transfer of hotels and motels saving time and effort submitting the conveyance for an assessment. First Home Owner Grant applications can now be lodged directly with RevenueSA removing lengthy paper based applications. |

| Treasury services: Revenue Collection and Management | Continue to manage the government’s land tax transition fund. | As at 30 June 2023 665 applications had been received and $2.5 million in ex-gratia relief has been provided. |

| Government Services: Shared services | Coordinate implementation of the government’s commitment to pay contractor invoices in 15 calendar days. | From February 2023 reporting was established to measure the volume and value of public authority invoices paid in 15 calendar days or less. Work is underway to complete the legislative, policy and system changes required to fully implement the government’s commitment, effective 1 July 2024. |

| Government Services: Shared services | Continue engagement with government suppliers on the progressive adoption of e- invoicing. |

Various government suppliers have been onboarded to submit e- invoices, with an aggregated invoice volume of more than 9,000 per annum (as of 30 June 2023).

Australian Taxation Office (ATO) reporting highlights that the SA Government is a leader in the adoption of e- invoicing at the national level. |

| Government Services: Shared services | Commence implementation of an electronic forms solution to streamline current human resources administrative practices. | A trial of a potential electronic forms solution to streamline human resources administrative processes has commenced within the Department of Treasury and Finance. |

| Government Services: Shared services | Complete deployment of the new version of the Basware invoice management system across SA Health. | Deployment of the new Basware invoice management system across SA Health was successfully completed in November 2022. |

| Government Services: Shared services | Develop a detailed business case to evaluate options for the replacement of the Masterpiece financial management system. |

The business case has been completed and funding approved to replace Masterpiece with a contemporary financial management system and associated integration platform.

Procurement activities to select the new systems were undertaken during the year. |

| Government Services: Shared services | Complete a major upgrade of the CHRIS 21 human resource management system to support implementation of Super SA’s fund selection legislation and phase 2 of the Australian Taxation Office’s Single Touch Payroll requirements. | The CHRIS 21 human resource management system was successfully upgraded in December 2022 to support Super SA’s fund selection legislation. |

| Government services: Government procurement | Complete the implementation of supported recommendations in response to the South Australian Productivity Commission (SAPC) and Statutory Authorities Review Committee inquiries into government procurement. | Procurement SA continues to implement recommendations from the SAPC including system architecture across government. |

| Government services: Government procurement | Establish new across government contracts for print equipment and related services, Microsoft licensing and support services, Adobe licensing, temporary staff services, audit and financial advisory services, supply of fuels for state government fleet vehicles, reticulated natural gas and renegotiate the domestic and international air travel contracts. |

New contracts have been established for print equipment and supply of fuels, and work has commenced on new natural gas contract, temporary staff, audit and financial and travel management.

A new Diploma of Procurement training provider contract was completed to support procurement staff across whole of government. |

| Government services: Government procurement | Commence procurements for across government contracts for voice, mobile and data carriage services, internet services, network devices and network management. | Procurement SA has commenced contracts for voice, mobile and data carriage services, internet, network devices and network management, temporary staff services and natural gas. |

| Government services: Government procurement | Establish a program to modernise and connect procurement, contract management and financial systems across the public sector. | Work is progressing on a program to modernise and connect procurement, contract management and financial systems across the public sector. |

| Government services: Government procurement | Launch a new masterclass series for procurement and contract management practitioners across the public service. | A new masterclass series was launched and was awarded a national CIPS award for the program in August. |

| Government services: Electorate services | Create a learning management system accessible to assistants to members of parliament staff that facilitates online access to respectful behaviours in the workplace training, and other training/policy material. | Completed |

| Government services: Electorate services | Deliver the remaining three electorate office relocations resulting from the 2020 Electoral Districts Boundaries Commission review. |

Frome Electorate Office relocation due to be completed 1 September 2023.

Alternative accommodation option for Elder Electorate Office relocation has been secured. This is a new build due for completion mid-2024. Lease negotiations for alternative accommodation for Enfield Electorate Office are currently underway. |

| Government services: Fines Enforcement and Recovery Unit | Optimise the resolution of fines and civil debt by full payment or payment arrangement. |

FERU continued to optimise resolutions of fines and civil debt.

In 2022-23 there was a 2.3% increase in total collections and over 7% increase in number of payment arrangements. |

| Government services: Fines Enforcement and Recovery Unit | Continue to identify non-financial resolution opportunities for vulnerable clients to address outstanding fines. | Continued to provide non-financial resolution options of vulnerable clients and commenced trial for expansion of non-financial resolution for clients experiencing gambling harm. |

| Government services: Fines Enforcement and Recovery Unit | Review and refresh external debt collection services to assist recovery in both fines and civil debt. | External debt collection services contract to be awarded in first quarter of 2023-24 for targeted debt recovery campaigns to progress. |

| Government services: Fines Enforcement and Recovery Unit | Explore further opportunities to expand self-service options for the Fines Unit clients. | FERU completed first stage of client self- service portal update and continued to explore alternative self- service opportunities to make it easy for clients to engage. |

The agency performance shown above does not include information relating to agencies that also publish their own Annual Report1, so as to avoid repetition.

1Compulsory Third Party regulator (CTPIRO), Lifetime Support Authority, Office of the Industry Advocate, South Australian Financing Authority (SAFA) and Super SA

| Program name | Performance |

|---|---|

| Graduate Program | DTF provides a Graduate Program which provides opportunities for graduates in accounting, finance, commerce, economics and procurement to gain exposure in multiple parts of the business. The program enables the graduates to work in a variety of areas within the business and focusses on assisting them to assimilate into the public sector, build their interpersonal skills and technical skills. In 2022-23 DTF engaged 25 graduates. |

| Skilling SA / Electorate Services Traineeships | DTF employed 26 Trainees in 2022-23. |

Performance management and development system | Performance |

|---|---|

Our Conversations | DTF employees have Development Plans in place which are facilitated and documented through the online system OurDevelopment. |

Program name | Performance |

|---|---|

Wellbeing for Our People | Implementation of the 2021-2024 Wellbeing for Our People program continued to support our employees through individual choice of initiatives to maximize wellbeing in the areas of ‘Mind’, ‘Body’, ‘Purpose’ and ‘Place’. This included 41 staff participating in the Be Well personal resilience program. 759 staff participated in the Influenza vaccinations. |

MyErgo | Transformed our checklist and action dashboard for improved automation to effectively manage our workstation ergonomic risk in the workplace. |

Workplace injury claims | 2022-23 | 2021-22 | % Change |

|---|---|---|---|

Total new workplace injury claims | 3 | 2 | +50% |

Fatalities | 0 | 0 | 0 |

Seriously injured workers* | 0 | 0 | 0 |

Significant injuries (where lost time exceeds a working week, expressed as frequency rate per 1000 FTE) | 0.8 | 0.6 | +33.33% |

Work health and safety regulations | 2022-23 | 2021-22 | % Change |

|---|---|---|---|

Number of notifiable incidents (Work Health and Safety Act 2012, Part 3) | 0 | 0 | 0 |

Number of provisional improvement, improvement and prohibition notices (Work Health and Safety Act 2012 Sections 90, 191 and 195) | 0 | 0 | 0 |

Return to work costs** | 2022-23 | 2021-22 | % Change |

|---|---|---|---|

Total gross workers compensation expenditure ($) | 500,912 | 707,280 | -29% |

Income support payments – gross ($) | 275,261 | 348,960 | -21% |

*before third party recovery

** includes expenditure of now defunct entities of which DTF administers the workers compensation claims.

Executive classification | Number of executives |

|---|---|

EXECOF | 1 |

SAES 2 | 11 |

SAES 1 | 35 |

| SAESSP | 1 |

Notes:

This table does not include executive employment in agencies that also publish their own Annual Report (Compulsory Third Party regulator, Lifetime Support Authority and Office of the Industry Advocate), so as to avoid repetition.

The Office of the Commissioner for Public Sector Employment (external site) has a workforce (external site) information (external site) page that provides further information on the breakdown of executive gender, salary and tenure by agency.

Financial performance

The following is a summary of the overall financial position of the agency. Full audited financial statements for 2022-2023 are attached to this report.

Statement of Comprehensive Income | 2022-23 Budget $’000 | 2022-23 Actual $’000 | Variation

$’000 | 2021-22 Actual $’000 |

|---|---|---|---|---|

Total income | 252,037 | 263,898 | 11,861 | 302,929 |

Total expenses | 252,884 | 262,708 | (9,824) | 290,891 |

Net result | (847) | 1,190 | 2,037 | 12,038 |

Total comprehensive result | (847) | 1,190 | 2,037 | 12,038 |

The 2022-23 comprehensive result of $1.2 million is $2.0 million higher than the budgeted deficit of $0.08 million. This improvement primarily reflects higher income including reimbursement for SA Government grants, subsidies and transfers, various fees and charges and resources received free of charge compared to budget. These are partially offset by higher expenditure for temporary staff filling vacant positions, consultancy costs for various commercial projects and Super SA strategic transformation projects.

Statement of Financial Position | 2022-23 Budget $’000 | 2022-23 Actual $’000 | Variation $’000 | 2021-22 Actual $’000 |

|---|---|---|---|---|

Current assets | 40,123 | 47,369 | 7,246 | 48,570 |

Non-current assets | 61,337 | 52,736 | (8,601) | 65,636 |

Total assets | 101,460 | 100,105 | (1,355) | 114,206 |

Current liabilities | 38,006 | 34,177 | 3,829 | 42,331 |

Non-current liabilities | 51,543 | 39,444 | 12,099 | 48,249 |

Total liabilities | 89,549 | 73,621 | 15,928 | 90,580 |

Net assets | 11,911 | 26,484 | 14,573 | 23,626 |

Equity | 11,911 | 26,484 | 14,573 | 23,626 |

The department’s actual net assets of $26.5 million at 30 June 2023 is $14.6 million higher than original budgeted outcome of $11.9 million. This primarily reflects net assets transferred out to other areas of government due to machinery of government changes.

Consultancies with a contract value below $10,000 each

Consultancies | Purpose | Actual payment ($) |

|---|---|---|

All consultancies below $10,000 each - combined | Various | 9,361 |

Consultancies with a contract value above $10,000 each

| Consultancies | Purpose | Actual payment ($) |

|---|---|---|

| Academie Consulting Pty Ltd | Financial advisor for the schools public private partnership project | 63,270 |

| Acton Advisory Pty Ltd | Consultancy services for various projects managed by Commercial and Economics branch | 50,000 |

| Amog Pty Ltd | Consultancy services for various projects managed by Commercial and Economics branch | 51,247 |

| BDO Services Pty Ltd | Probity services for various projects managed by the Commercial and Economics branch | 57,930 |

| Corporate Scorecard Pty Ltd | Finance credit rating assessment on the Financial Management System/iPaaS vendors | 20,900 |

| CQ Energy Pty Ltd | Provide subject matter advice for the across- government tender for gas | 16,380 |

| Creativation Pty Ltd | Pricing advice to support the invitation to supply for the provision of a new Financial Management System and iPaaS | 40,727 |

| Deloitte Consulting Pty Ltd | Engagement of a superannuation prudential management specialist | 102,625 |

| Deloitte Financial Advisory | Consultancy services for the Board of Treasurer’s Early Intervention and Innovation initiative | 107,940 |

| Deloitte Risk Advisory Pty Ltd | Penetration testing and vulnerability assessment of the DTF payroll system | 43,741 |

| DXC Enterprise Australia P/L | Review of DTF’s mainframe requirements with accompanying recommendations | 215,818 |

| Ernst & Young | Consultancy services for various projects managed by Commercial and Economics branch | 446,711 |

| GHD Pty Ltd | Consultancy services for various projects managed by Commercial and Economics branch | 105,418 |

| Gray Andreotti Advisory | Consultancy services for various projects managed by Commercial and Economics branch | 83,531 |

| Hannan & Partners Pty Ltd | Consultancy services for the Frontier payroll system remediation project | 84,000 |

| Infrastructure SA | Ecological assessment for Northern Water Supply projects and Upper Spencer Gulf projects | 27,409 |

| JBS&G Australia Pty Ltd | Consultancy services for various projects managed by Commercial and Economics branch | 16,879 |

| KPMG | Preparation of a strategic business case for the proposed replacement of the whole of government financial system | 199,081 |

| KPMG | Provision of vision stage consultancy services for the Finance Reform program | 649,185 |

| Leadership Solutions Global | Preparation and facilitation of a DTF Executive team leadership session | 14,000 |

| Michael Rice | Superannuation expertise and guidance to the Super SA Member Outcomes and Insurance Committee | 39,554 |

| The NTF Group | Superannuation specialist assistance on Super SA strategic projects | 246,650 |

| O’Connor Marsden & Associate Pty Ltd | Probity Services for various projects managed by the Commercial and Economics branch | 25,540 |

| O’Connor Marsden & Associate Pty Ltd | Probity advisory services for the Finance Reform program | 51,337 |

| Payroll Matters Pty Ltd | Provision of technical payroll services | 25,200 |

| Peter King | Review of the Treasury Service function for the SA Financing Authority | 30,217 |

| PricewaterhouseCoopers | Independent review of the Return to Work SA amendment bill cost impact analysis | 65,000 |

| PricewaterhouseCoopers | Consultancy services for various projects managed by Commercial and Economics branch | 69,251 |

| Synergy IQ Pty Ltd | Development of a recruitment and retention strategy for Shared Services SA | 22,995 |

| Total | 2,972,536 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual- (external site) report-statistics/resource/566b8f6f-ce5c-4d7a-943b-2d7b69f5d76c (external site)

See also the Consolidated Financial Report of the Department of Treasury and (PDF) Finance (PDF) for total value of consultancy contracts across the South Australian Public Sector.

The following is a summary of external contractors that have been engaged by the agency, the nature of work undertaken, and the actual payments made for work undertaken during the financial year.

Contractors with a contract value below $10,000

Contractors | Purpose | Actual payment ($) |

|---|---|---|

| All contractors below $10,000 each - combined | Various | 107,077 |

Contractors with a contract value above $10,000 each

| Contractors | Purpose | $ Actual payment |

|---|---|---|

| Acton Advisory Pty Ltd | Ongoing financial advice for the Royal Adelaide Hospital private public partnership | 60,000 |

| Akkodis Australia Consulting | Data analytics pilot for payroll services leveraging the Power BI platform | 41,250 |

| Arcblue Consulting (Aus) P/L | Provision of procurement services for the Fines Unit | 57,360 |

| Area9 Pty Ltd | Transition of defect management software to JIRA Cloud Services | 64,000 |

| ASG Group Limited | Project management services to support the development and delivery of key Super SA strategic programs | 43,727 |

| Australia Post | Provision of payment processing services for Revenue SA | 268,680 |

| BDO Services Pty Ltd | Development and delivery of a procurement systems business case | 24,338 |

| BDO Services Pty Ltd | Provision of staff training for Super SA | 32,363 |

| Between Pty Ltd | Critical IT support for the South Australian Government Financing Authority | 140,434 |

| Biz Hub Australia Pty Ltd | Revenue SA Online (RSAOL) system application management services | 98,877 |

| Bonita Kennedy | Preparation of the SA Financing Authority’s record management disposal schedule | 13,056 |

| Bonita Kennedy | Development of a records disposal schedule for DTF | 13,440 |

| Bravura Solutions Operations | Minor enhancement to Super SA’s SuperB and EPASS systems | 11,031 |

| Brett & Watson Pty Ltd | Preparation of an actuarial certificate for the schemes administered by Super SA | 26,000 |

| Capgemini Australia Pty | Design and implementation of the new Super SA corporate website | 15,551 |

| CKM Management Solutions Pty Ltd | Management accounting services to assist in the preparation annual agency statements | 27,473 |

| CKM Management Solutions Pty Ltd | Undertake ‘Acquire to Retire’ and ‘Plan to Perform’ activities for the Finance Reform program | 270,600 |

| Commonwealth Bank of Australia | Provision of payment processing services for RevenueSA | 681,332 |

| Data 3 Ltd | Design and deployment of firewalls for the Parliamentary Network Support Group | 42,973 |

| Debtrak Pty Ltd | Debt collection software licenses and system maintenance services | 224,320 |

| Deloitte Risk Advisory Pty Ltd | Super SA internal audit services | 275,330 |

| Digital Resilience | Super SA cyber security contracting services | 97,234 |

| E-Matrix Training | Provision of staff training for the Fines Unit | 24,716 |

| Empired Ltd | Design and implementation of the new Super SA corporate website | 23,175 |

Ernst & Young | Review the effectiveness of fraud risk management controls for the department | 32,500 |

Essential Utilities | Pricing analysis of respondents to a telecommunications open tender | 30,000 |

Expose Data Pty Ltd | Creation of a cloud-based data analytics platform in Super SA | 309,906 |

Financial IQ Pty Ltd | Strategic product development and implementation of Super SA’s Enterprise Release 3 project | 20,586 |

Financial IQ Pty Ltd | Development and implementation of Super SA’s Unit Pricing project | 103,715 |

Financial IQ Pty Ltd | Optimisation of Super SA business processes | 171,602 |

Financial IQ Pty Ltd | Development and implementation of Super SA’s Choice of Funds strategic project | 190,682 |

Fraser Financial Modelling | Financial modelling services for the Finance Reform program | 40,150 |

Fueltrac | Monthly procurement audit services | 24,150 |

Fujitsu Australia Ltd | Revenue Information Online (RIO) system support and application management services | 1,562,561 |

Gillespie Advertising Pty Ltd | Creative concepts and copywriting for Super SA campaigns | 33,250 |

Hudson Global Resources (Aust) | Provision of services for the State Owned Generators Leasing Co Pty Ltd | 29,724 |

Illion Digital Tech Solutions | Provision of external debt collection services | 88,000 |

Industry Fund Services P/L | Financial planning services for Super SA members | 1,303,036 |

Iocane Pty Ltd | Provision of disaster recovery services and server hosting | 89,069 |

KPMG | Professional support services the KPMG Financial Reporting tool | 60,294 |

KPMG | Taxation advice on Super SA’s statutory obligations | 150,597 |

KPMG | Specialist communication services for Super SA’s Fund Selection project | 197,548 |

Lane Laser Printers P/L | Provision of printing and dispatch services | 159,957 |

Lobsterpot Solutions Pty Ltd | Provision of data migration and customisation services for the Fines Unit | 306,569 |

Mercer Consulting (Aust) P/L | AASB valuation of the Electric Super Scheme | 20,000 |

Mercer Consulting (Aust) P/L | Actuarial review of superannuation schemes | 27,400 |

Monkeystack Pty Ltd | Develop and deliver explanatory animated videos explaining a number of Super SA projects | 11,886 |

MYOB Australia P/L | Financial advice and financial scheme software upgrades for Super SA | 12,386 |

Nucleus Media Australia P/L | Super SA net zero campaign | 10,960 |

O’Connor Marsden & Associate Pty Ltd | Support for the temporary staff procurement project | 13,274 |

Pernix Pty Ltd | Development of a proof of concept for a Vendor Information portal using Microsoft Power Aps | 30,000 |

PricewaterhouseCoopers | Engagement of an external consultant for the performance of the Triple S Insurance Pool triennial review (actuarial review) | 70,380 |

PricewaterhouseCoopers | Internal audit services for the department | 240,796 |

Reculver Processing Services | Secure inbound mail processing services | 72,819 |

S4G Consulting Pty Ltd | Development of an architecture study to document the current and future information technology operating needs of Super SA | 46,080 |

SS&C | Statement of works for the Bluedoor System for Super SA | 1,290,693 |

Thirty Nine Pine Pty Ltd | Critical funding and balance sheet management for the South Australian Government Financing Authority’s financial markets division | 88,820 |

University of Adelaide | Provision of training for the Graduate development program | 74,773 |

| Total | 9,491,423 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual- (external site) report-statistics/resource/388db0dd-fbf5-487f-a8e3-07414d9bbadd (external site)

The details of South Australian Government-awarded contracts for goods, services, and works are displayed on the SA Tenders and Contracts website. View the agency (external site) list of contracts (external site).

The website also provides details of across government contracts (external site)

Risk Management

In 2022-23, DTF managed its risks using online systems and tools, conducted reviews in key areas of risk, and co-ordinated year-end assurance processes to support the preparation of DTF’s financial statements. DTF’s Risk and Performance Committee continued to provide high-level oversight of the Risk Management Framework and its implementation across the Department. In 2022-23 the Committee conducted oversight activities related to protective security and cyber risks, financial statements, audit, and internal controls.

Category/nature of fraud | Number of instances |

|---|---|

Timesheet fraud | 1 |

NB: Fraud reported includes actual and reasonably suspected incidents of fraud.

DTF is committed to:

- preventing, detecting, and controlling fraud, corruption, maladministration, and misconduct in connection with the Department’s activities, and has a zero-tolerance approach to fraud, corruption, or other criminal conduct, maladministration, and misconduct.

- minimising the incidence of fraud and corruption through sound financial, legal, and ethical decision-making and organisational practices

- promoting the principles of honesty and integrity consistent with the Code of Ethics for the South Australian Public Sector.

DTF’s Fraud and Corruption Policy and Control Framework outlines the Department’s processes for preventing, detecting and responding to fraud.

DTF Branch Heads are responsible for ensuring adequate controls are in place to manage fraud risks, including identifying new risks and implementing further controls where identified. Assurance of the adequacy of these internal controls is provided by Branch Heads annually as part of DTF’s year-end declaration process.

DTF’s second line of defence monitoring programs, along with the internal audit plan reviews, provide reporting to the Risk and Performance Committee for oversight on the effectiveness of fraud controls and the implementation of recommended actions.

Detection, control, and prevention activities within DTF include:

- Disclosure by staff of suspected or actual fraudulent behaviour

- Reviews of transaction reports

- Reviews of management reports

- Data analysis – including continuous control monitoring

- Conflict of interest declarations

- Gifts and benefits declarations

- Employee screening

- Confidentiality arrangements

- Internal and external audits

- Appropriate segregation of duties

- Financial policies and procedures

- Post incident review of internal controls

- Financial Management Compliance Program (FMCP)

- Financial year-end declaration processes

- Mandatory fraud and corruption awareness training for new and existing employees.

Data for previous years is available at: Department of Treasury and Finance Annual (external site) Report statistics - Dataset - data.sa.gov.au (external site)

Number of occasions on which public interest information has been disclosed to a responsible officer of the agency under the Public Interest Disclosure Act 2018: One (1)

Data for previous years is available at: Department of Treasury and Finance Annual (external site) Report statistics - Dataset - data.sa.gov.au (external site)

Note: Disclosure of public interest information was previously reported under the Whistleblowers Protection Act 1993 and repealed by the Public Interest Disclosure Act 2018 on 1/7/2019.

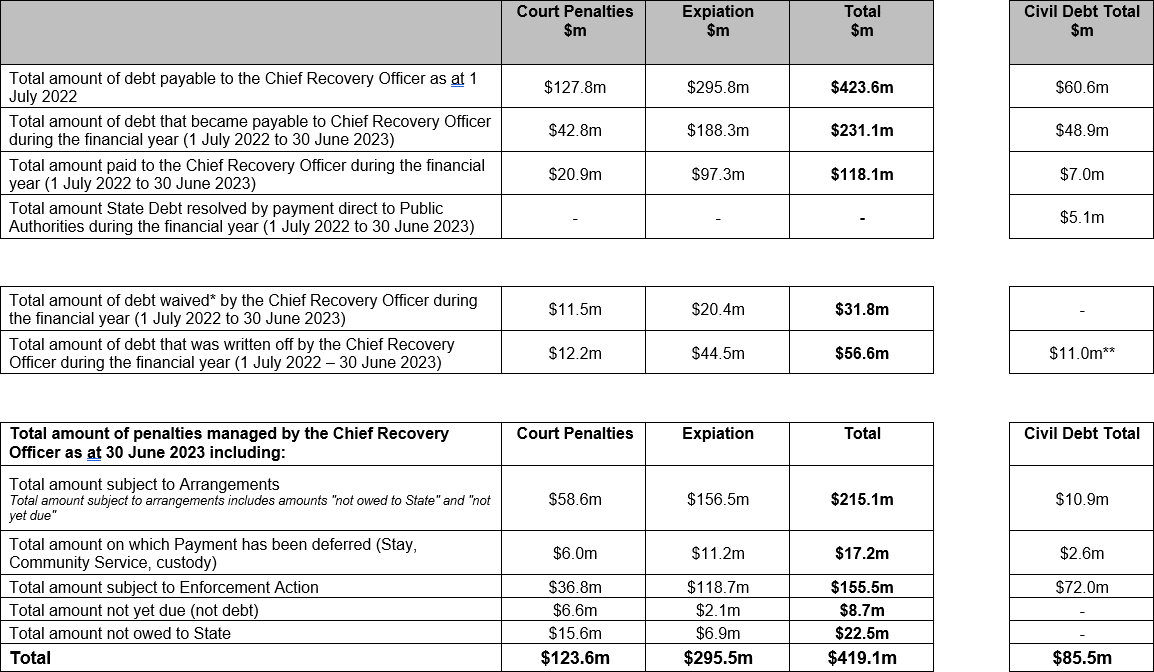

Act or Regulation | Requirement |

|---|---|

Fines Enforcement and Debt Recovery Act 2017 | Regulations - Part 4 |

All payments from debtor contact are made to the Fines Enforcement and Recovery Unit not delegated external agencies.

*The Chief Recovery Officer has absolute discretion to waive full/part payment of an enforced fine. When an enforced fines is waived the liability for payment is expunged.

**The Fines Enforcement and Debt Recovery Act 2017 does not provide for the Chief Recovery Officer to write- off Civil Debt, however the Chief Recovery Officer will make recommendations to the Public Authority the debt belongs to, to withdraw the debt and consider write-off. The Public Authority can also withdraw the debt at any time. Those instances are reflected here.

Public complaints

Shared services

| Complaint categories | Sub-categories | Example | Number of Complaints 2022-23 |

|---|---|---|---|

Professional behaviour | Staff attitude | Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency | 1 |

Professional behaviour | Staff competency | Failure to action service request; poorly informed decisions; incorrect or incomplete service provided | 0 |

Professional behaviour | Staff knowledge | Lack of service specific knowledge; incomplete or out-of-date knowledge | 0 |

Communication | Communication quality | Inadequate, delayed or absent communication with customer | 2 |

Communication | Confidentiality | Customer’s confidentiality or privacy not respected; information shared incorrectly | 1 |

Service delivery | Systems/technology | System offline; inaccessible to customer; incorrect result/information provided; poor system design | 0 |

Service delivery | Access to services | Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities | 0 |

Service delivery | Process | Processing error; incorrect process used; delay in processing application; process not customer responsive | 4 |

Policy | Policy application | Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given | 0 |

Policy | Policy content | Policy content difficult to understand; policy unreasonable or disadvantages customer | 0 |

Service quality | Information | Incorrect, incomplete, out-dated or inadequate information; not fit for purpose | 0 |

Service quality | Access to information | Information difficult to understand, hard to find or difficult to use; not plain English | 0 |

Service quality | Timeliness | Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met | 2 |

Service quality | Safety | Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness | 0 |

Service quality | Service responsiveness | Service design doesn’t meet customer needs; poor service fit with customer expectations | 0 |

No case to answer | No case to answer | Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate | 0 |

| Total | 10 |

Additional metrics | Total |

|---|---|

Number of positive feedback comments | 8 |

Number of negative feedback comments | 0 |

Total number of feedback comments | 8 |

% complaints resolved within policy timeframes | 90 |

Revenue SA

| Complaint categories | Sub-categories | Example | Number of Complaints 2022-2023 |

|---|---|---|---|

Professional behaviour | Staff attitude | Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency | 3 |

Professional behaviour | Staff competency | Failure to action service request; poorly informed decisions; incorrect or incomplete service provided | 0 |

Professional behaviour | Staff knowledge | Lack of service specific knowledge; incomplete or out-of-date knowledge | 2 |

Communication | Communication quality | Inadequate, delayed or absent communication with customer | 5 |

Communication | Confidentiality | Customer’s confidentiality or privacy not respected; information shared incorrectly | 0 |

Service delivery | Systems/technology | System offline; inaccessible to customer; incorrect result/information provided; poor system design | 24 |

Service delivery | Access to services | Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities | 5 |

Service delivery | Process | Processing error; incorrect process used; delay in processing application; process not customer responsive | 11 |

Policy | Policy application | Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given | 9 |

Policy | Policy content | Policy content difficult to understand; policy unreasonable or disadvantages customer | 205 |

Service quality | Information | Incorrect, incomplete, out-dated or inadequate information; not fit for purpose | 2 |

Service quality | Access to information | Information difficult to understand, hard to find or difficult to use; not plain English | 3 |

Service quality | Timeliness | Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met | 34 |

Service quality | Safety | Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness | 0 |

Service quality | Service responsiveness | Service design doesn’t meet customer needs; poor service fit with customer expectations | 11 |

No case to answer | No case to answer | Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate | 0 |

| Total | 314 |

Additional metrics | Total |

|---|---|

Number of positive feedback comments | 15 |

Number of negative feedback comments | |

Total number of feedback comments | |

% complaints resolved within policy timeframes | 81% |

Fines Enforcement and Recovery Unit

| Complaint categories | Sub-categories | Example | Number of Complaints 2022-23 |

|---|---|---|---|

Service delivery | Access to services | Online access not easily accessible (login or navigation) for clients. | 5 |

Service delivery | Process | Long wait times for clients and not responsive service delivery. | 16 |

No case to answer | No case to answer | Includes Ministerial correspondence, Ombudsman enquiries and general feedback from clients whereby clients were disgruntled with legislated process being applied by FERU (eg no case to answer), the matter related to a third party or another agency (and therefore transferred/ redirected to another agency), the client was not aware of the fines or civil debt process (eg client misunderstanding). | 38 |

| Total | 59 |

Additional Metrics | Total |

|---|---|

Number of positive feedback comments | 4 |

Number of negative feedback comments | 59 |

Total number of feedback comments | 63 |

% complaints resolved within policy timeframes | 100% |

Super SA

| Complaint categories | Sub-categories | Example | Number of Complaints 2022-23 |

|---|---|---|---|

Professional behaviour | Staff attitude | Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency | 1 |

Professional behaviour | Staff competency | Failure to action service request; poorly informed decisions; incorrect or incomplete service provided | 0 |

Professional behaviour | Staff knowledge | Lack of service specific knowledge; incomplete or out-of-date knowledge | 0 |

Communication | Communication quality | Inadequate, delayed or absent communication with customer | 29 |

Communication | Confidentiality | Customer’s confidentiality or privacy not respected; information shared incorrectly | 4 |

Service delivery | Systems/ technology | System offline; inaccessible to customer; incorrect result/information provided; poor system design | 25 |

Service delivery | Access to services | Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities | 2 |

Service delivery | Process | Processing error; incorrect process used; delay in processing application; process not customer responsive | 136 |

Policy | Policy application | Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given | 6 |

Policy | Policy content | Policy content difficult to understand; policy unreasonable or disadvantages customer | 31 |

Service quality | Information | Incorrect, incomplete, out-dated or inadequate information; not fit for purpose | 4 |

Service quality | Access to information | Information difficult to understand, hard to find or difficult to use; not plain English | 2 |

Service quality | Timeliness | Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met | 0 |

Service quality | Safety | Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness | 0 |

Service quality | Service responsiveness | Service design doesn’t meet customer needs; poor service fit with customer expectations | 0 |

No case to answer | No case to answer | Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate | 3 |

Investments | Investments | Investment fees; dissatisfaction with investment of assets | 6 |

| Total | 249 |

Additional metrics | Total |

|---|---|

Number of positive feedback comments | 122 |

Number of negative feedback comments | 43 |

Total number of feedback comments | 165 |

% complaints resolved within policy timeframes | 79% within 45 days |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual- report-statistics (external site)

Fines Enforcement and Recovery Unit (FERU)

In line with PC039- Complaint Management in the South Australian Public Sector, FERU conducted an annual assessment and ongoing monitoring of its performance and Complaint Management System. FERU received some positive compliments about service delivery and staff professionalism, which were encouraging. Complaints were received from clients regarding FERU’s prescribed enforcement powers being actioned, in particular garnishing of bank accounts and the imposing of restrictions with the Registrar of Motor Vehicles. While improvements continue to be explored and implemented in providing self-service options to clients and providing clients with plain English information on FERU’s enforcement powers, this continues to be a theme where clients are aggrieved by the application of legislated processes.

In early 2023, FERU experienced high call volumes which ultimately resulted in a higher number of complaints around service response times and wait times experienced by clients. FERU’s complaints management system was reviewed and improved to ensure that all complaints were responded to within best practice and policy timeframes, and that all complaints around service delivery and response times were addressed as quickly as possible. FERU implemented a number of workforce strategies by taking action to increase capacity and meet the service expectations of the community and making significant improvements to the client self-service online portal including strengthening security with 2 factor authentication access.

The online self-service portal offers a range of services including adding a fine to an existing payment arrangement, updating contact details or making a general online enquiry for further assistance.

FERU’s strategic direction continues to have a clear focus on striving to be part of a world class Treasury and Finance and providing professional, respectful and empathetic service and interactions to our clients, to ensure we maintain best practice client service delivery outcomes. These strategic goals include continuing to be the debt recovery provider of choice, ensuring we work in an efficient and effective way, maintaining a skilled and valued workforce, and having the right tools and best facilities for an efficient and responsive debt recovery service to meet expectations for both clients, and government.

Super SA

Implemented the new industry best-practice disputes resolution process on 1 July 2022, which better aligns to the Australian Securities and Investment Commission Dispute Resolution Regulatory Guide 271. The new process makes it easier for our Super SA members to raise a complaint, and imposes more stringent recording and reporting of complaints, including the identification of trends and systemic issues.

With the implementation of the new disputes resolution process, the Super SA Board set a key performance indicator to keep complaint numbers below 250 for the 2022-23 financial year, and this was achieved with 249 complaints received in the year.

Amendments were made to enhance the options available to eligible members, to provide flexibility to:

- choose their preferred superannuation fund (“Fund Selection”);

- rollover (all or part) of their Super SA account to another complying super fund whilst still employed with the SA Government (“Portability”); and

- direct their employer contributions from non- SA Government to Super SA in certain circumstances (“Limited Public Offer”).

Engagement of a new medical advisory service, to enhance the claims assessment and insurance process and reduce turnaround times.

Further revised the Board delegations to allow for a more simplified and streamlined payment process for smaller, or low risk payments, to improve response times.

Introduced rules and processes to enable the acceptance of electronic or digital signatures on instructions from members in particular (low-risk) circumstances, to streamline our processes and makes it simpler and easier for our members.

Made further improvements to the member online portal, to make it easier for members to register, while maintaining enhanced security measures.

Revised the communication option to ‘electronic’ as a default for all members who are registered with Member Portal, to provide faster and safer communication.

Updated the Annual Statements to communicate important information, including details around insurance premiums, the effect of low balance accounts on insurance, and the distribution of payments upon death.

Revised numerous communications, including forms and fact sheets to provide clearer information and instructions.

Improvements to a number of other communications, including confirmation to members who purchase insurance, or who are claiming insurance benefits, to pre- empt queries and reduce confusion.

Compliance Statement

Department of Treasury and Finance is compliant with Premier and Cabinet Circular 039 – complaint management in the South Australian public sector | Y |

Department of Treasury and Finance has communicated the content of PC 039 and the agency’s related complaints policies and procedures to employees. | Y |